Joint Account

Fill in the TBAU Non-Individual Account Opening Form (For joint account, please complete section 1, 3, 7, 8.1.)

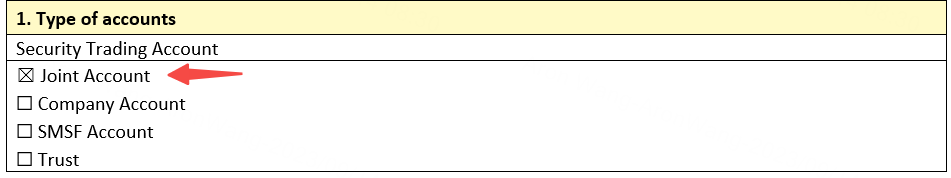

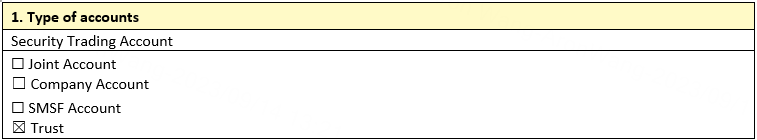

Section 1, select joint account

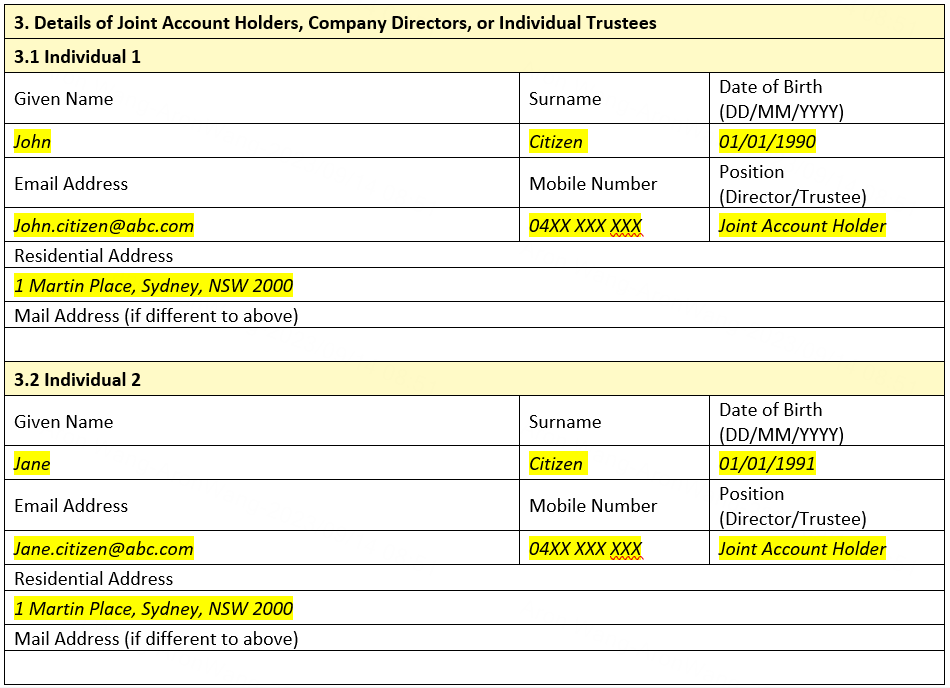

Section 3, fill in the two joint account holders' personal details

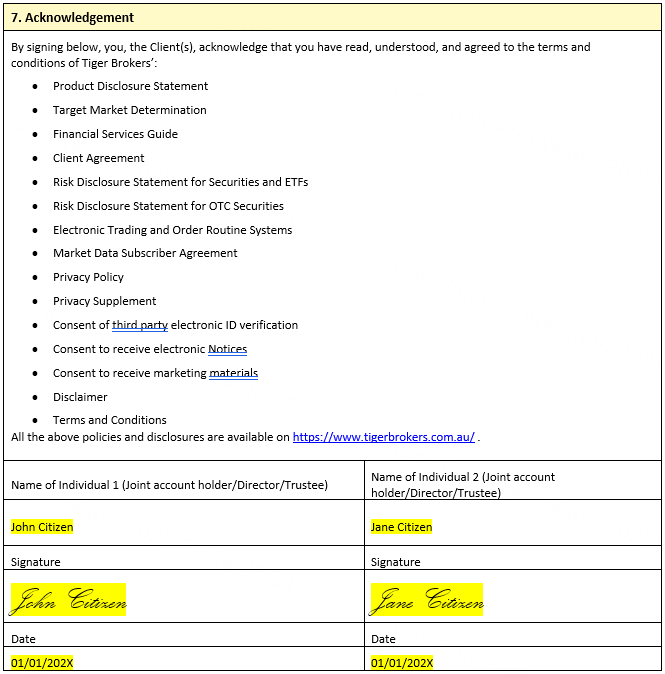

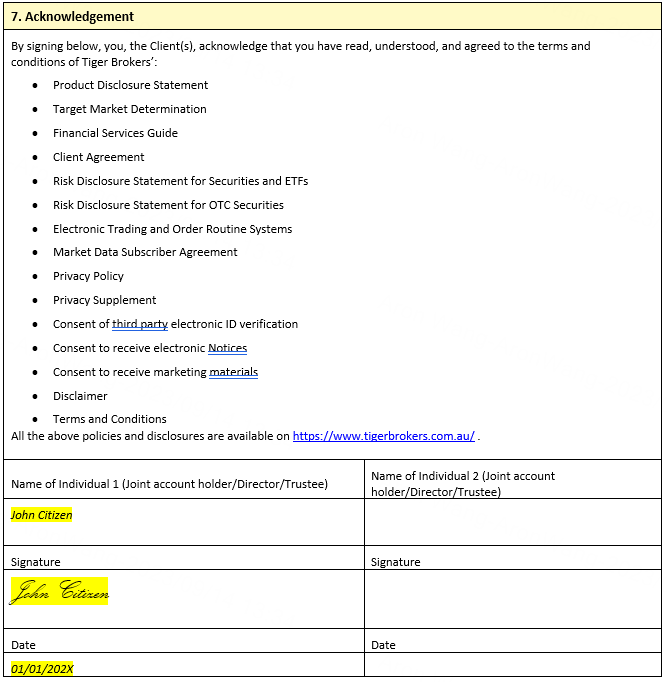

Section 7, please sign and date the acknowledgement section.

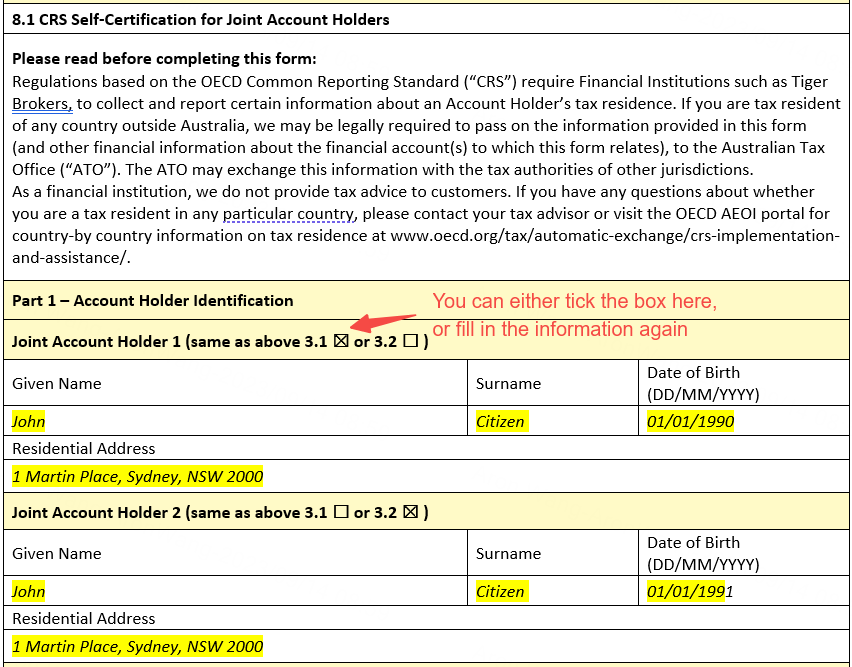

Section 8.1, please complete and sign the CRS section.

Part 1, you can either tick the box in the form or fill in the personal information again.

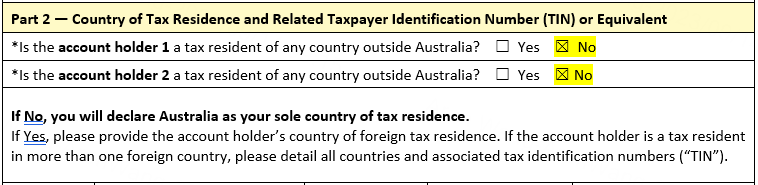

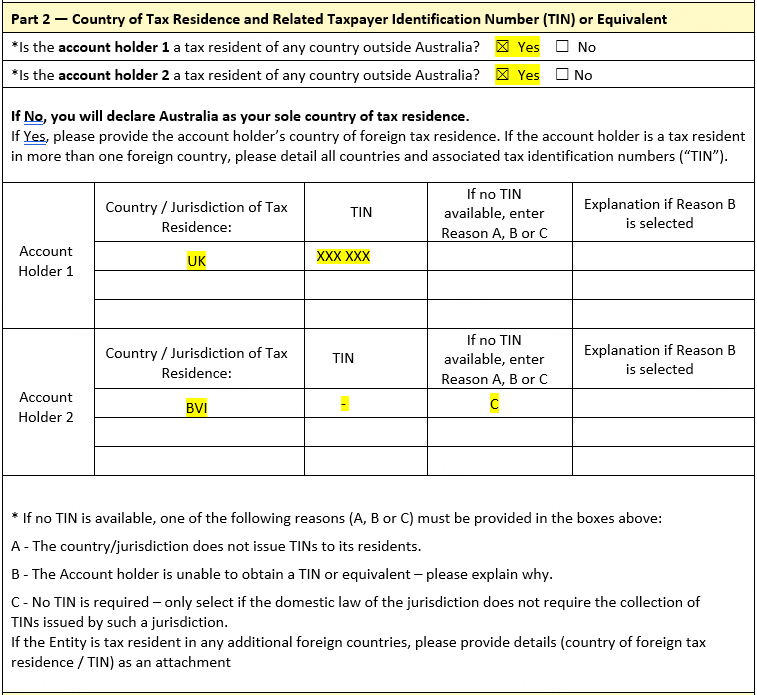

Part 2,

If you selected 'No' and declare Australia as your sole country of tax residence, you can disregard the remaining part 2 and continue with the signing in Part 3.

If any of the joint account holders selected 'Yes', please complete the remaining part of Part 2.

Part 3, please complete the declaration and signing part.

Once the account application is completed and signed, please send the application form together with the following documents to clientservice@tigerbrokers.com.au. Our designated client service team will contact you to assist your account opening process.

Primary photographic identification for both joint account applicants (e.g., Australian Driver Licence, Australian/Foreign Passport)

Company

Fill in the TBAU Non-Individual Account Opening Form (For company, please complete section 1, 3, 4, 7, 8.2.)

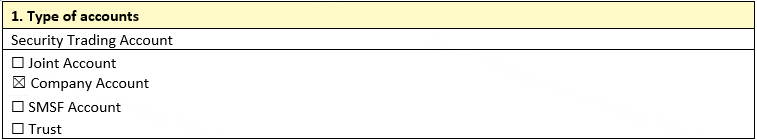

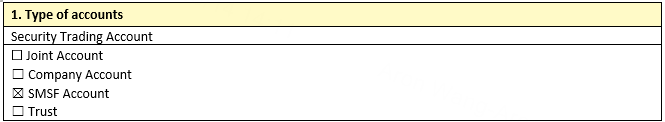

Section 1, select company account

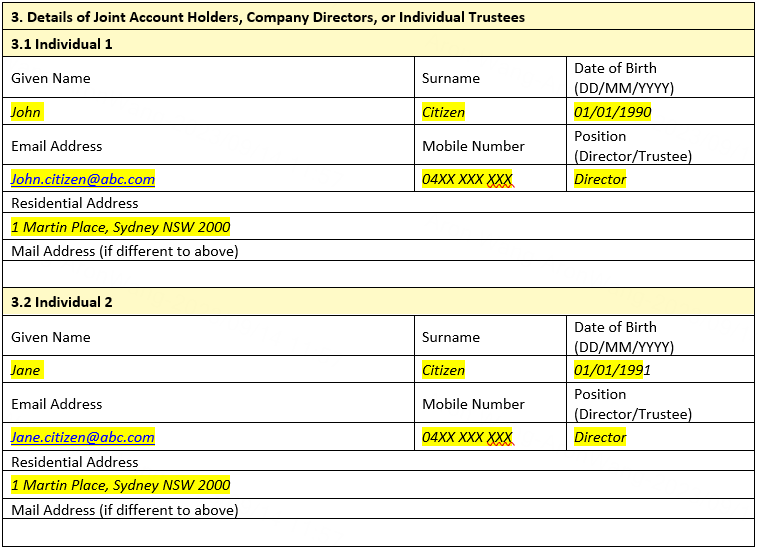

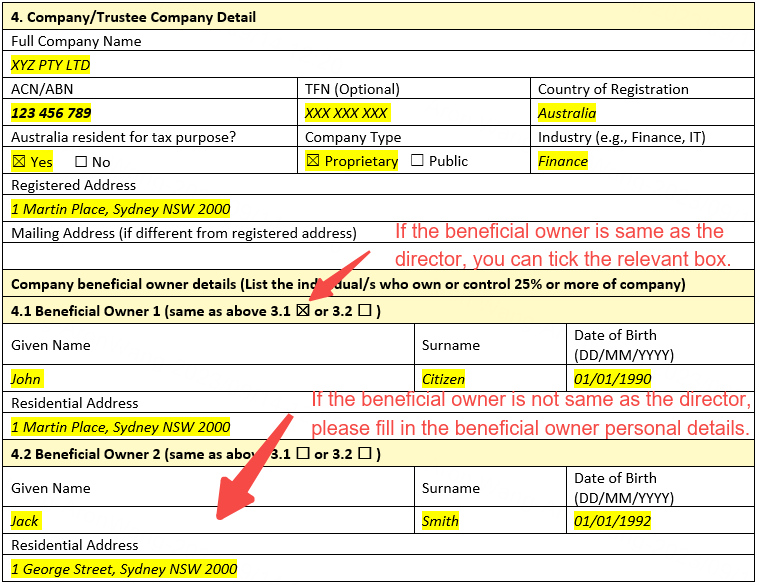

Section 3, fill in the one or two company director/s' personal details (if there are more than two directors, please add tables in the form)

Section 4, fill in the company details: if there is any beneficial owner who is not a director, please also fill in the personal details.

Section 7, please sign and date the acknowledgement section.

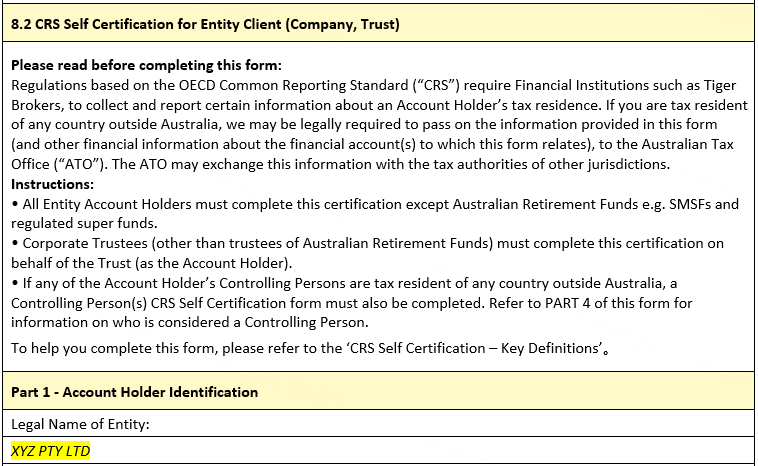

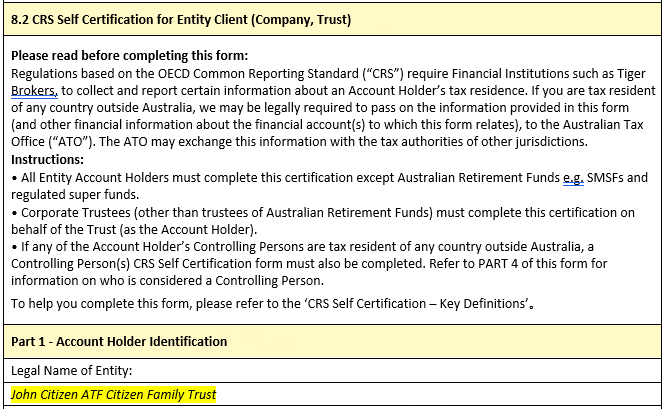

Section 8.2, please complete and sign the CRS section.

Part 1, entity name (full legal name should be in line with company extract from regulatory body)

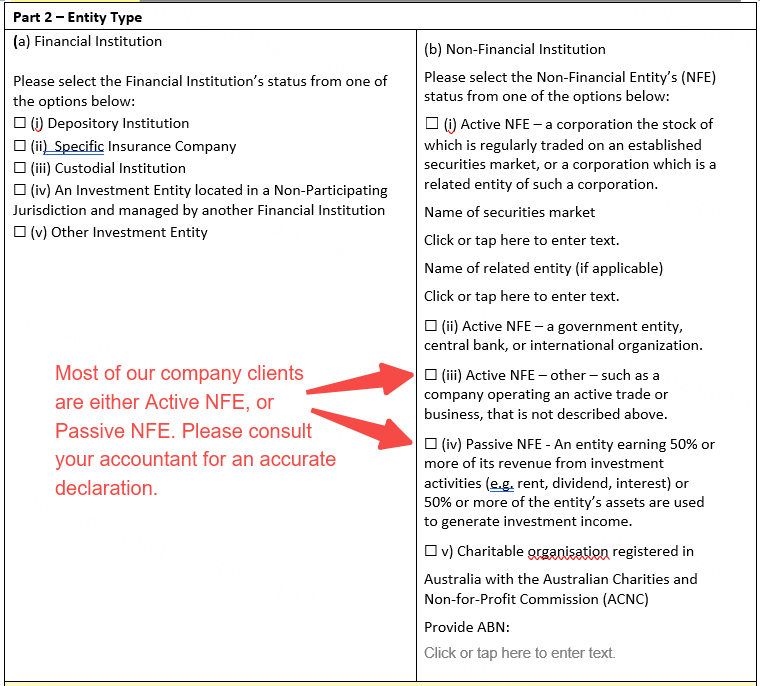

Part 2, please complete the CRS entity type. If you are unsure about your entity type, please seek professional accounting advice.

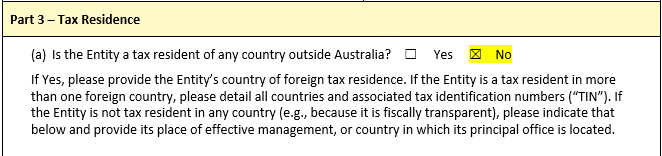

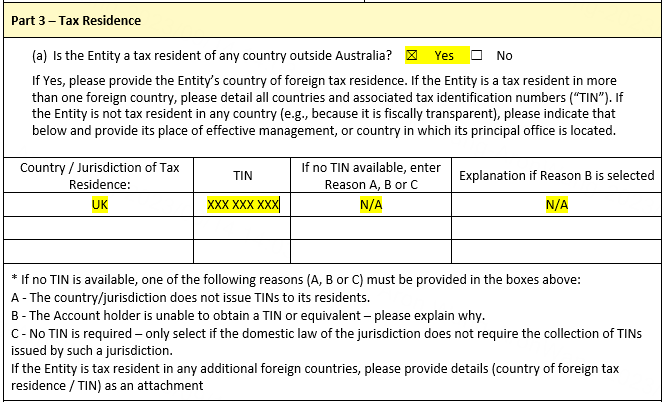

Part 3, tax residence:

If you selected 'No' and declare Australia as your sole country of tax residence, you can disregard the remaining part 3 and continue to Part 3.

If you selected 'Yes', please complete the Part 3.

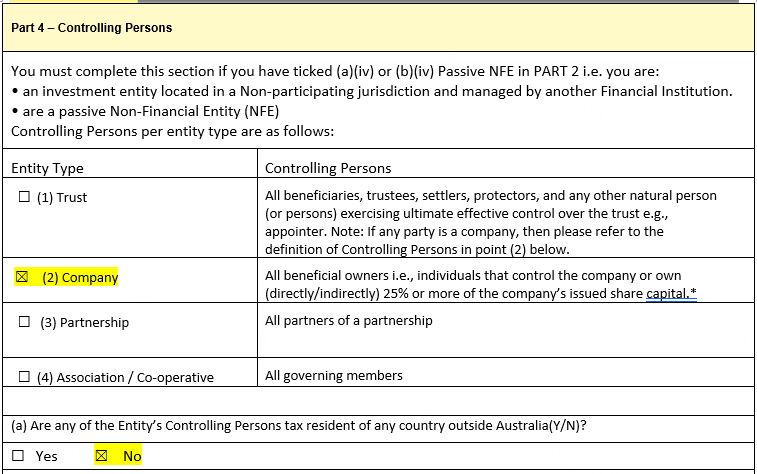

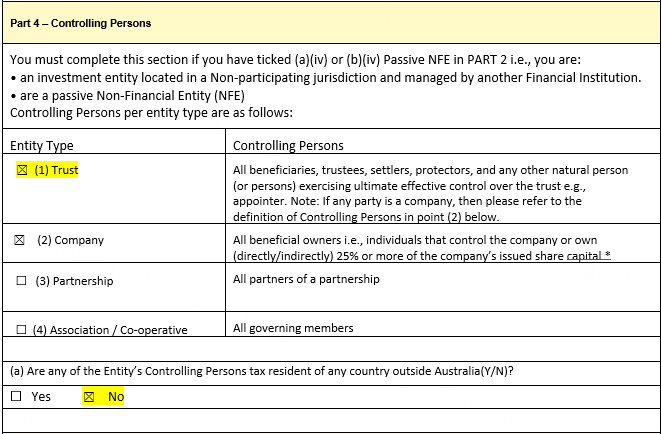

Part 4, Controlling Person. (if you are an investment entity located in a Non-participating jurisdiction and managed by another Financial Institution or a passive Non-Financial Entity (NFE), you need to complete Part 4 and indicate there any controlling person is non-Australian tax residents.

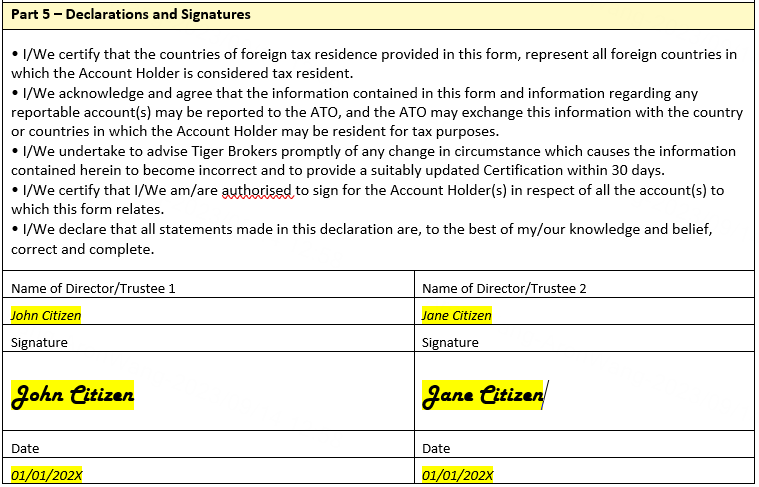

Part 5, the CRS declaration needs to be signed by the company director/s.

Once the account application is completed and signed, please send the application form together with the following documents to clientservice@tigerbrokers.com.au. Our designated client service team will contact you to assist your account opening process.

Primary photographic identification for all directors and beneficial owners (who owns directly or indirectly over 25% of the company beneficial interest) - e.g., Australian Driver Licence, Australian/Foreign Passport

A completed W-8BEN-E form.

Trust

Individual Trustee

Fill in the TBAU Non-Individual Account Opening Form (For trust with individual trustee, please complete section 1, 3, 5, 7, 8.2.)

Section 1, select trust account

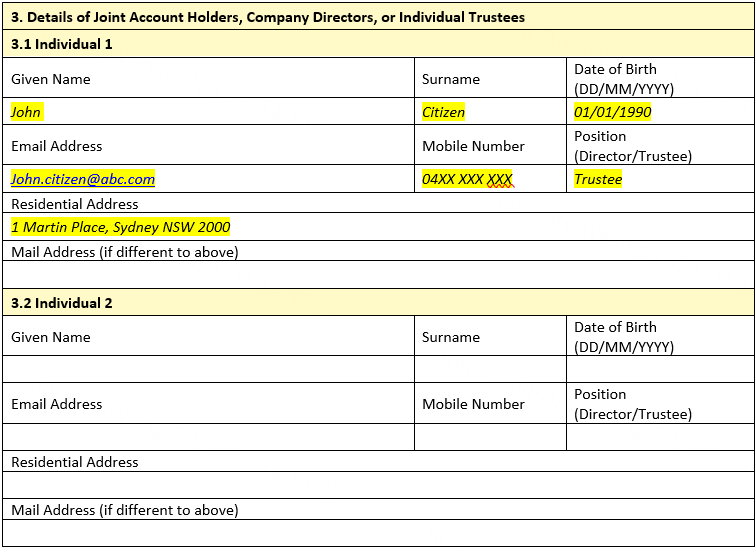

Section 3, fill in the individual trustee details (if there is more than one individual trustee, please add tables in the form)

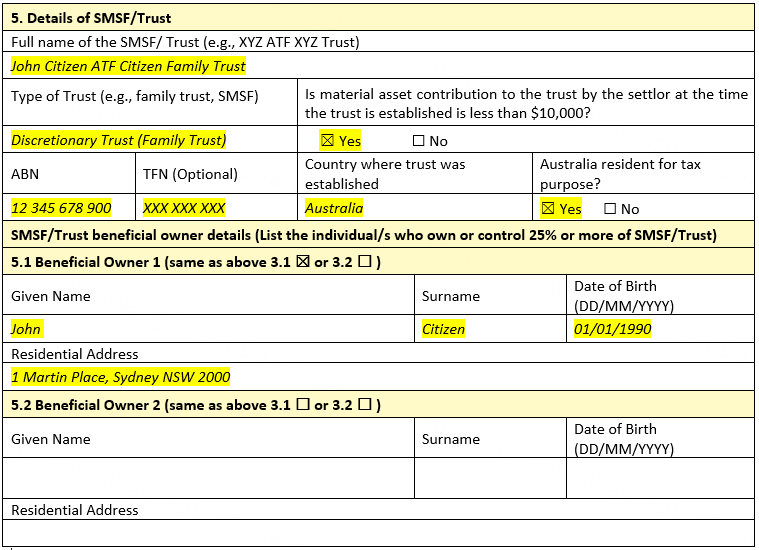

Section 5, fill in the trust details: if there is any beneficial owner who is not a trustee, please also fill in the personal details.

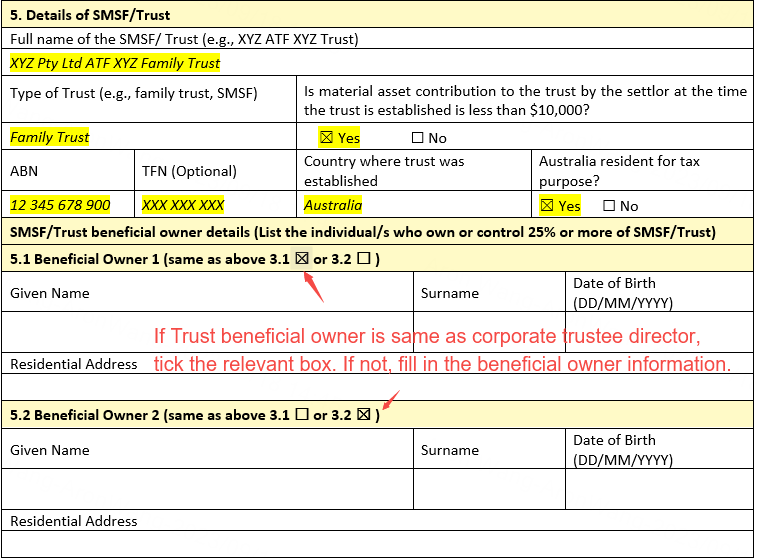

The full legal name of the trust should include both the trustee name and the trust name

If the material asset contribution to the trust by the settlor at the time the trust is established is more than A$10,000, we need to collect the identification of the settlor.

Section 7, please sign and date the acknowledgement section.

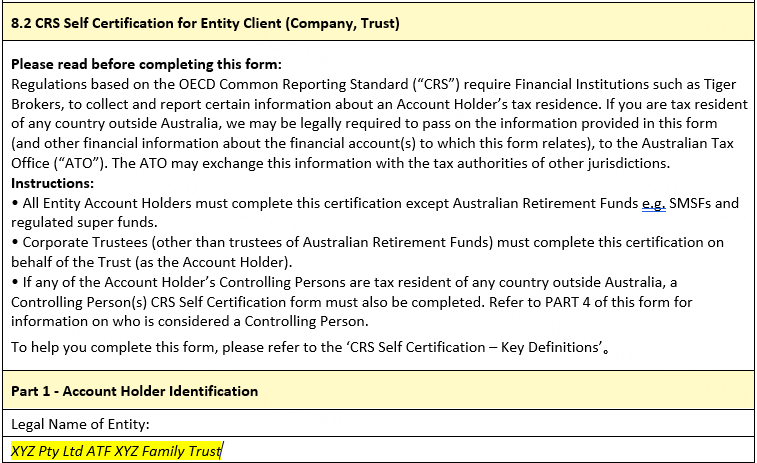

Section 8.2, please complete and sign the CRS section.

Part 1, entity name (full trust legal name)

Part 2, please complete the CRS entity type. If you are unsure about your entity type, please seek professional accounting advice.

Part 3, tax residence:

If you selected 'No' and declare Australia as your sole country of tax residence, you can disregard the remaining part 3 and continue to Part 3.

If you selected 'Yes', please complete the Part 3.

Part 4, Controlling Person. (if you are an investment entity located in a Non-participating jurisdiction and managed by another Financial Institution or a passive Non-Financial Entity (NFE), you need to complete Part 4 and indicate there any controlling person is non-Australian tax residents.

Part 5, the CRS declaration needs to be signed by the individual trustee/s.

Once the account application is completed and signed, please send the application form together with the following documents to clientservice@tigerbrokers.com.au. Our designated client service team will contact you to assist your account opening process.

Primary photographic identification for all directors and beneficial owners (who owns directly or indirectly over 25% of the company beneficial interest) - e.g., Australian Driver Licence, Australian/Foreign Passport

A completed W-8BEN-E form.

Corporate Trustee

Fill in the TBAU Non-Individual Account Opening Form (For trust with individual trustee, please complete section 1, 3, 4, 5, 7, 8.2.)

Section 1, select trust account

Section 3, fill in the corporate trustee director's details (if there is more than one individual trustee, please add tables in the form)

Section 4, fill in the company trustee details: if there is any beneficial owner who is not a director, please also fill in the personal details.

Section 5, fill in the trust details: if there is any beneficial owner who is not a trustee, please also fill in the personal details.

The full legal name of the trust should include both the trustee name and the trust name

If the material asset contribution to the trust by the settlor at the time the trust is established is more than A$10,000, we need to collect the identification of the settlor.

Section 7, please sign and date the acknowledgement section.

Section 8.2, please complete and sign the CRS section.

Part 1, entity name (full trust legal name)

Part 2, please complete the CRS entity type. If you are unsure about your entity type, please seek professional accounting advice.

Part 3, tax residence:

If you selected 'No' and declare Australia as your sole country of tax residence, you can disregard the remaining part 3 and continue to Part 3.

If you selected 'Yes', please complete the Part 3.

Part 4, Controlling Person. (if you are an investment entity located in a Non-participating jurisdiction and managed by another Financial Institution or a passive Non-Financial Entity (NFE), you need to complete Part 4 and indicate there any controlling person is non-Australian tax residents.

Part 5, the CRS declaration needs to be signed by the individual trustee/s.

Once the account application is completed and signed, please send the application form together with the following documents to clientservice@tigerbrokers.com.au. Our designated client service team will contact you to assist your account opening process.

Primary photographic identification for all individual trustees and beneficial owners (who has directly or indirectly beneficial interest over 25%) - e.g., Australian Driver Licence, Australian/Foreign Passport

A completed W-8BEN-E form.

A certified copy of the Trust Deed

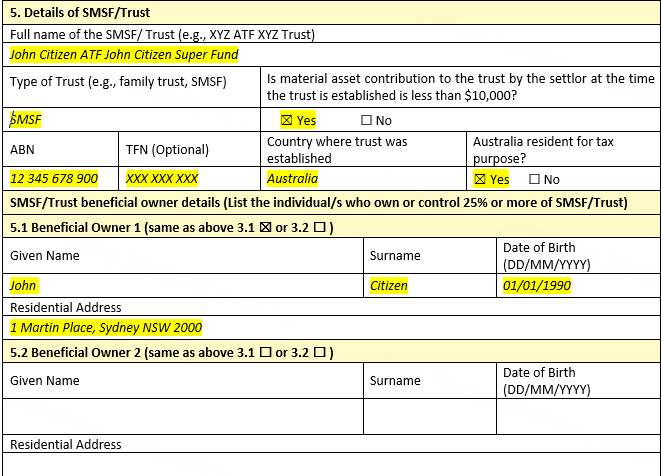

SMSF

Individual Trustee

Fill in the TBAU Non-Individual Account Opening Form (For SMSF with individual trustee, please complete section 1, 3, 5, 7)

Section 1, select SMSF account

Section 3, fill in the individual trustee details (if there is more than one individual trustee, please add tables in the form)

Section 5, fill in the SMSF details.

The full legal name of the trust should include both the trustee name and the SMSF name

Section 7, please sign and date the acknowledgement section.

As SMSF is registered retirement fund with ATO, it is not required to complete the CRS self-certification.

Once the account application is completed and signed, please send the application form together with the following documents to clientservice@tigerbrokers.com.au. Our designated client service team will contact you to assist your account opening process.

Primary photographic identification for all individual trustees and beneficial owners (who has directly or indirectly beneficial interest over 25%) - e.g., Australian Driver Licence, Australian/Foreign Passport

A completed W-8BEN-E form.

A certified copy of the Trust Deed

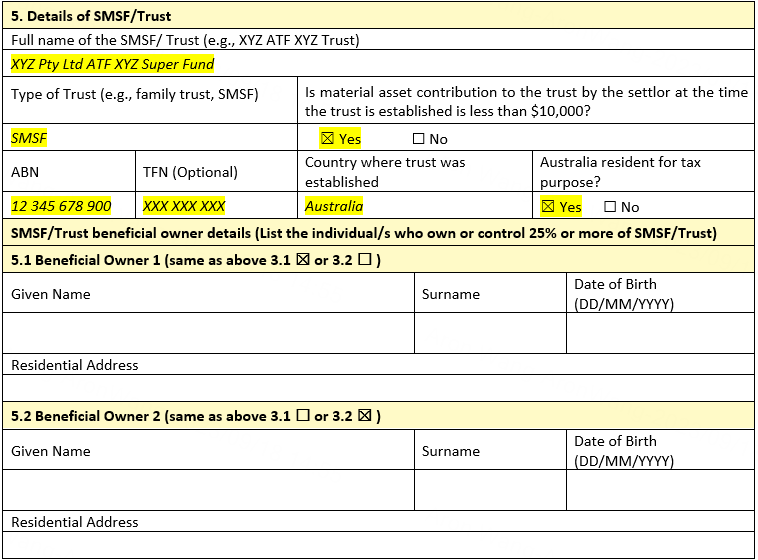

Corporate Trustee

Fill in the TBAU Non-Individual Account Opening Form (For SMSF with individual trustee, please complete section 1, 3, 5, 7)

Section 1, select SMSF account

Section 3, fill in the corporate trustee director's details (if there is more than one individual trustee, please add tables in the form)

Section 4, fill in the trustee company details: if there is any beneficial owner who is not a director, please also fill in the personal details.

Section 5, fill in the trust details: if there is any beneficial owner who is not a trustee, please also fill in the personal details.

The full legal name of the trust should include both the trustee name and the trust name

If the material asset contribution to the trust by the settlor at the time the trust is established is more than A$10,000, we need to collect the identification of the settlor.

Section 7, please sign and date the acknowledgement section.

As SMSF is registered retirement fund with ATO, it is not required to complete the CRS self-certification.

Once the account application is completed and signed, please send the application form together with the following documents to clientservice@tigerbrokers.com.au. Our designated client service team will contact you to assist your account opening process.

Primary photographic identification for all individual trustees and beneficial owners (who has directly or indirectly beneficial interest over 25%) - e.g., Australian Driver Licence, Australian/Foreign Passport

A completed W-8BEN-E form.

A certified copy of the Trust Deed