ETFs are gaining popularity among investors. In the Us according to CNBC in September 2022 3,000 ETFs were trading simultaneously for the first time ever. This was an increase of 30% from December 2020's figures.

So, what are ETFs and what's their creation and redemption process?

An exchange-traded fund (ETF) tracks multiple stocks, securities, or other assets to let you invest in a sector, industry, or even region. You could also track an index through an ETF, so you don’t have to pick individual stocks. By investing in an ETF, investors can spread their money across a group of investments, giving instant diversification.

While that is the literal explanation of an ETF, to further understand them better let's break the ETF down. Understanding the creation process, and examples of some popular ETFs is a great starting point for investors. This process helps identify what ETFs belong in which sectors and how they are grouped together.

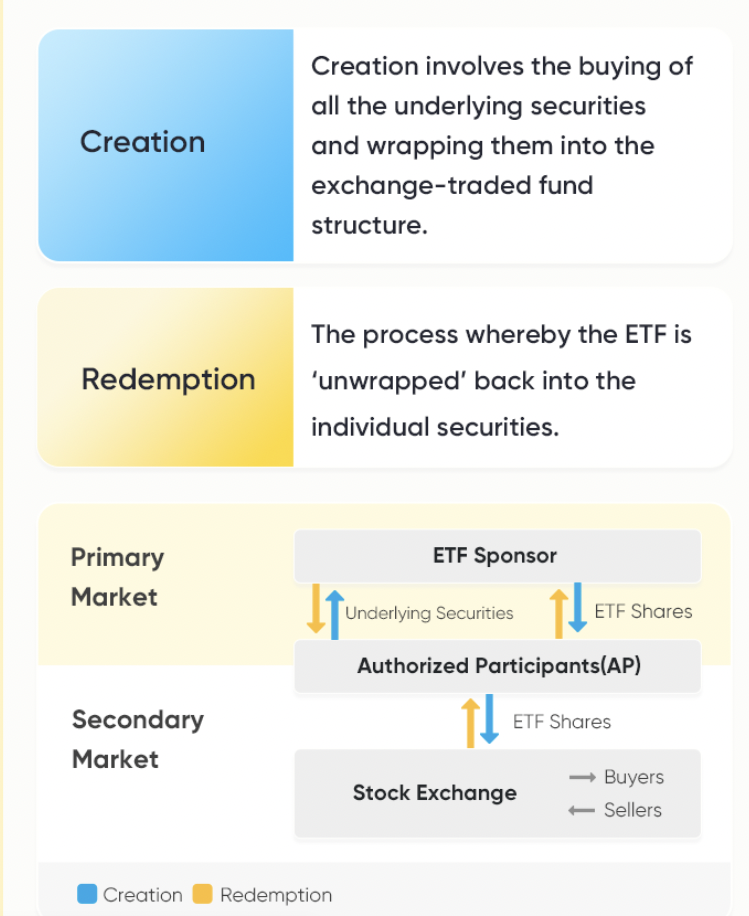

ETF creation and redemption process

An Authorised Participant (AP) is a financial institution, often a bank, that dynamically manages the creation and redemption of ETF shares in the primary market. This process adjusts the number of ETF shares outstanding and helps keep an ETF’s price aligned with the value of its underlying securities.

APs create ETF shares in large increments—known as creation units—by assembling the underlying securities of the fund in their appropriate weightings to reach the creation unit size, which is typically 50,000 ETF shares. The AP then delivers those securities to the ETF sponsor. In return, the ETF sponsor bundles the securities into the ETF wrapper and delivers the ETF shares to the AP. These newly created ETF shares are then introduced to the secondary market, where they are traded between buyers and sellers through the exchange.

An overview of popular ETFs and underlying assets

-

SPY

The Standard and Poor Depositary Receipts (SPDR) S&P 500 ETF was launched on January 22, 1993, making it the very first exchange-traded fund listed in the United States. It is listed on the New York Stock Exchange and trades under the ticker symbol SPY. The SPY’s price tracks the S&P 500 index. The S&P 500 stock market index, which is made up of the 500 largest companies listed on US stock exchanges, is considered the best indicator of the overall health of the US Economy.

The main competitors for the SPY ETF are other large, low-cost, widely traded ETFs and mutual funds that track the S&P 500 index. Examples of SPY ETF's competitors, in terms of assets under management, include: iShares Core S&P 500 ETF (IVV), Vanguard 500 Index ETF (VOO) and the mutual fund Vanguard 500 Index (VFIAX)

-

QQQ

Invesco QQQ is an ETF that tracks the Nasdaq-100 Index with a ticker of QQQ. The Index includes the 100 largest non-financial companies listed on the Nasdaq based on market cap. The Nasdaq-100 is a stock market index made up of 102 equity securities issued by 101 of the largest non-financial companies listed on the Nasdaq stock exchange, including American Depository Receipts. It has a unique sector mix, with a heavy focus on the information technology and consumer discretionary sectors.

-

DIA

SPDR Dow Jones Industrial Average ETF tracks Dow Jones Industrial Average with a ticker of DIA. Dow Jones Industrial Average is also known as the Dow or the Dow 30, the blue-chip index debuted in 1896 and remains widely followed today. Of its 30 current members, only General Electric Company (NYSE: GE ) was an original member. It is recognised as the home to some of the most venerable and widely held companies in the US. That means DIA's roster, in addition to GE, includes holdings such as Boeing Co (NYSE: BA ), Apple Inc. (NASDAQ: AAPL ), and 3M Co (NYSE: MMM ).

Capital at risk. See risk disclosures, FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767