To get a more holistic picture of why Exchange Traded Funds (ETFs) are popular with investors we'll look at a brief history of ETFs, the differences between an ETF and other assets, and look at two examples of popular US ETFs- the Vanguard S&P 500 (VOO) and the Health Care Select Sector SPDR® Fund (XLV), the VOO is an index fund and the XLV is a sector ETF.

Key takeaways

-

Trading ETFs is just like trading a stock, except your money is split across a range of investments instead of put into just one company.

-

ETF share prices fluctuate all day as the ETF is bought and sold; this is different from mutual funds, which only trade once a day after the market closes.

-

ETFs can contain all types of investments, including stocks, commodities, or bonds; some offer US-only holdings, while others are international.

-

Compared with mutual funds, ETFs offer low expense ratios.

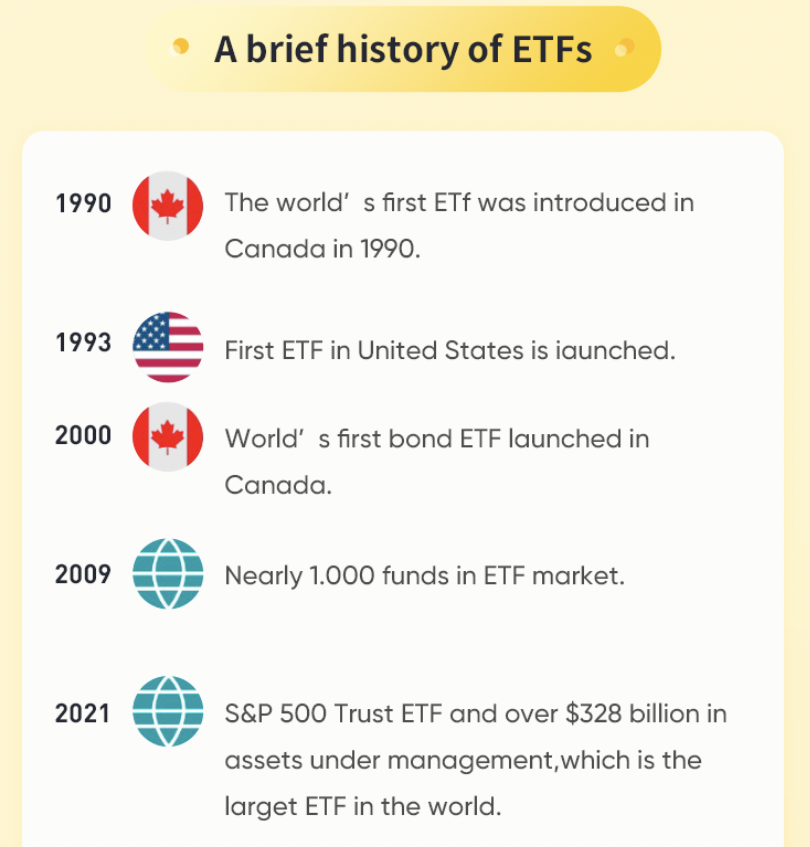

A brief history of ETFs

ETFs are not a new asset as they have been around since the 1990s, however, their popularity has really started to take off in recent years. Below is a brief history of ETFs and when they first were created.

Examples of index and sector ETFs

These two examples are of some of the most popular ETFs that are trading on the US stock market.

Index ETF: Vanguard S&P 500 ETF (VOO)

Key Summaries:

-

Invests in stocks in the S&P 500 Index, representing 500 of the largest US companies.

-

The goal is to closely track the index’s return, which is considered a gauge of overall US stock returns.

The 10 largest stock portfolio holdings of VOO taken from the Vanguard S&P 500 ETF website as of 31/07/2022:

|

Ticker

|

Holdings

|

% of a fund

|

|

APPL

|

Apple Inc.

|

7.12 %

|

|

MSFT

|

Microsoft Corp.

|

5.98 %

|

|

AMZN

|

Amazon.com Inc.

|

3.36 %

|

|

TSLA

|

Tesla Inc.

|

2.13 %

|

|

GOOGL

|

Alphabet Inc. Class A

|

1.99 %

|

|

GooG

|

Alphabet Inc. Class C

|

1.84 %

|

|

BRK.B

|

Berkshire Hathaway Inc. Class B

|

1.55 %

|

|

UNH

|

UnitedHealth Group Inc.

|

1.45 %

|

|

JNJ

|

Johnson & Johnson

|

1.31 %

|

|

NVDA

|

NVIDIA Corp.

|

1.3 %

|

*Percentages will change with the stock market movement. For updates see https://investor.vanguard.com/investment-products/etfs/profile/voo#portfolio-composition

Sector ETF: The Health Care Select Sector SPDR® Fund (XLV)

Key Summaries:

-

The Index seeks to provide an effective representation of the healthcare sector of the S&P 500 Index

-

Seeks to provide precise exposure to companies in the pharmaceuticals; health care equipment and supplies; health care providers and services; biotechnology; life sciences tools and services; and healthcare technology industries.

The 10 largest stock portfolio holdings of XLV taken from State Street Global Advisors as of 24/08/2022:

|

Ticker

|

Holdings

|

% of a fund

|

|

UNH

|

UnitedHealth Group Inc.

|

10.32%

|

|

JNJ

|

Johnson & Johnson

|

8.93%

|

|

PFE

|

Pfizer Inc.

|

5.45%

|

|

ABBV

|

AbbVie Inc.

|

5.15%

|

|

LLY

|

Eli Lilly and Company

|

5.00%

|

|

MRK

|

Merck & Co. Inc.

|

4.66%

|

|

TMO

|

Thermo Fisher Scientific Inc.

|

4.49%

|

|

ABT

|

Abbott Laboratories

|

3.91%

|

|

DHR

|

Danaher Corporation

|

3.62%

|

|

BMY

|

Bristol-Myers Squibb Company

|

3.17%

|

*Percentages will change with the stock market movement. Check here for updates https://www.ssga.com/us/en/individual/etfs/funds/the-health-care-select-sector-spdr-fund-xlv

To further explain the differences between ETFs and other assets available on the stock market, this section will look at their comparisons against mutual funds and stocks, as well as the risks involved with investing in ETFs.

The advantages and comparisons with mutual funds and stocks

The advantages of ETFs

- Diversification

ETFs allow investors to access many stocks across various industries, for example, they may track different industries, sectors, or types of companies. They may offer risk management through diversification.

- Accessibility

Investing in an ETF is similar to investing in an individual stock, the main difference is that investing in an ETF means you're investing in a particular group of stocks.

- Transparency

Because they’re traded on an exchange, you get visibility on share price movements and can sell your shares whenever there are interested buyers.

ETFs vs Mutual Funds vs Stocks

|

|

ETFs

|

US Mutual Funds

|

Stocks

|

|

Definition

|

ETFs track multiple stocks, securities, or other assets to let you invest in a sector, industry, or even region

|

A mutual fund is a professionally managed fund that pools money from investors and then invested in various types of asset classes including equities, bonds, and money market instruments.

|

Stocks are securities that provide returns based on performance.

|

|

Disclosures

|

ETF holdings are disclosed daily or monthly.

|

Fund managers are required to disclose holdings once per quarter at a minimum

|

The SEC expects public companies to file financial reports each of the first three quarters of every fiscal year

|

|

The Net Asset Value (NAV )

|

An ETF’s market price is the price at which investors can buy or sell an ETF on an exchange. This price may deviate from the NAV of the ETF depending on demand for and supply for the ETF at a point in time.

|

Mutual fund prices trade at the net asset value of the overall fund.

|

Stock returns are based on their actual performance in the markets.

|

|

Management fees

|

ETFs expense ratios generally are lower than mutual funds.

|

Mutual funds charge marketing fees and administrative fees. While fees vary, the average equity mutual fund management fee is about 1.40%.

|

The commission of stocks investing is charged by the broker and normally it is commission-free.

|

|

Trading time

|

ETFs are traded in the markets during regular hours just like stocks are.

|

Mutual funds can be redeemed only at the end of a trading day.

|

Stocks are traded during regular market hours.

|

|

Ownership

|

ETFs do not involve actual ownership of securities.

|

Mutual funds own the securities in their basket.

|

Stocks involve physical ownership of the security.

|

|

Risk diversification

|

ETFs, diversify risk by tracking different companies in a sector or industry in a single fund.

|

Mutual funds diversify risk by creating a portfolio that spans multiple asset classes and security instruments.

|

Risk is concentrated in a stock’s performance.

|

|

Performance

|

Depends on the market's performance

|

Depends on the fund manager's portfolio's performance.

|

Depend on the individual stock's actual performance in the markets.

|

The risks of investing in ETFs

Below are some general risks related to ETF trading. Please note this list does not outline all risks and there may be other factors and risks to consider.

- Market risk

ETFs are typically designed to track the performance of certain indices, market sectors, or groups of assets such as stocks, bonds, or commodities. ETF managers may use different strategies to achieve this goal, but in general, they do not have the discretion to take defensive positions in declining markets. Investors must be prepared to bear the risk of loss and volatility associated with the underlying index/assets.

- Tracking risk

Tracking errors refer to the disparity in performance between an ETF and its underlying index/assets. Tracking errors can arise due to factors such as the impact of transaction fees and expenses incurred to the ETF, changes in the composition of the underlying index/assets, and the ETF manager's replication strategy. The common replication strategies include full replication/representative sampling and synthetic replication. Simply put, a synthetic ETF is designed to replicate the return of a selected index (e.g., S&P 500 or FTSE 100) just like any other ETF.

- Trading at a discount or premium

An ETF may be traded at a discount or premium to its Net Asset Value (NAV). This price discrepancy is caused by supply and demand factors and may likely emerge during periods of high market volatility and uncertainty. This phenomenon may also be observed for ETFs tracking specific markets or sectors that are subject to direct investment restrictions.

- Foreign exchange risk

Investors trading ETFs with underlying assets not made in the base currency of their accounts are also exposed to exchange rate risk. Currency rate fluctuations can adversely affect the underlying asset value, also affecting the ETF price.

- Liquidity risk

Market Makers (MMs) are Exchange Participants that provide liquidity to facilitate trading in ETFs. Although most ETFs are supported by one or more MMs, there is no assurance that active trading will be maintained. In the event that the MMs default or cease to fulfill their role, investors may not be able to buy or sell the product.

Capital at risk. See risk disclosures, FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767