There are a few types of ETFs that are currently available to investors each with its own basket of companies specific to the ETFs purpose and creation. Do you know what a bond ETF is compromised of or what a commodity ETF is? Additionally, what is an inverse or leveraged ETF and also what risks may be associated with these particular ETFs.

ETFs are generally characterised as either passive or actively managed. There is a distinct difference between the two that investors should be aware of. A passively managed ETF is created to replicate the performance of the broad equity market or a segment of it by mirroring the holdings of a particular index. Where as an actively managed ETF has a manager or team making decisions on the underlying portfolio allocation. The number of actively managed ETFs is small compared to the total number of ETFs. Actively managed ETFs make up 1%-2% of the total average trading volume.

-

Bond ETFs

Bond ETFs invest in various income securities and like stock ETFs, they are grouped into certain categories. Their income distribution depends on the performance of the underlying bonds. They might include government bonds, corporate bonds, and state and local bonds. Unlike the underlying instruments, which are normally with a long period of maturity, bond ETFs do not have a maturity date.

-

Stock ETFs

Stock ETFs are comprised of a basket of stocks that track a single industry or sector. For example, a stock ETF might track automotive or foreign stocks. The aim is to provide diversified exposure to a single industry, one that includes high performers and new entrants with potential for growth. Unlike stock mutual funds, stock ETFs have lower fees and do not involve actual ownership of securities.

-

Industry/Sector ETFs

Industry or sector ETFs are funds that focus on a specific sector or industry. Industry/Sector ETFs give you access to a very small part of the overall market, such as energy, real estate, fashion, and health care, among others. Sector ETFs offer varied stability, depending on which industry you select.

-

Currency ETFs

Currency ETFs are pooled investment vehicles that track the performance of currency pairs, consisting of domestic and foreign currencies. Currency ETFs can be used to speculate on the prices of currencies based on political and economic developments in a country. They are also used to diversify a portfolio or as a hedge against volatility in forex markets by importers and exporters.

-

Commodity ETFs

Commodity ETFs usually focus on physical commodities, such as agricultural goods, natural resources, and precious metals. A commodity ETF is usually focused on either a single commodity held in physical storage or investments in the commodities futures contract. Long-term investors should consider the security of underlying assets, such as the “contango” and “roll cost ” problems.

-

Inverse ETFs

When the stock market is falling or a particular market sector or commodity is struggling individual investors can make bearish trades that will profit from those declines. Shorting is done by selling a stock when expecting a decline in value, and repurchasing it at a lower price. Traditionally this meant that investors had to be able to short stocks or use options, but now there is another way to profit from the downside of the market using inverse ETFs. Inverse ETFs are quite common, such as equity, currency, fixed income, alternatives and etc.

-

Leveraged ETFs

Leverage involves borrowing in order to amplify the returns of an investment. This means that potential gains, but also losses, can be increased. For instance, if the S&P 500 rises 1%, an S&P 500 ETF Bull ETF will return 2% (and if the index falls by 1%, the ETF would lose 2%). However, leveraged ETFs such as triple-leveraged (3x) ETFs come with considerable risk and are not appropriate for long-term investing.

Risks associated with L&I ETFs

Inverse and leveraged ETFs (L&I) can be great for short-term trades but their risks should not be ignored.

Like ETFs, the risks of L&I ETFs can include counterparty risk, market risk, tracking errors, trading at discount or premium, foreign exchange risk, and liquidity risk. In addition, L&I ETFs are complicated instruments that should only be used by sophisticated investors who fully understand the terms, investment strategy and risks associated with them. In particular, investors should be aware of certain specific risks involved in trading L&I ETFs. These risks include, but are not limited to:

1. Use of leverage and derivative instruments – Many L&I ETFs use leverage and derivative instruments to achieve their stated investment objectives. As such, these L&I ETFs can be extremely volatile and carry a high risk of substantial losses. These L&I ETFs are considered speculative investments and should only be used by investors who fully understand the risks and are willing and able to absorb potentially significant losses.

2. Most L&I ETFs seek daily target returns – Most L&I ETFs "reset" daily, meaning that they are designed to achieve their stated objectives on a daily basis. Due to the effect of compounding, the return for investors who invest for a period different than one trading day may vary significantly from the L&I ETF's stated goal as well as the target benchmark's performance. This is especially true in very volatile markets or if a leveraged ETF is tracking a very volatile underlying index. Investments in L&I ETFs must be actively monitored on a daily basis and are typically not appropriate for a buy-and-hold strategy.

3. Higher operating expenses and fees – Investors should be aware that leveraged ETFs typically rebalance their portfolios on a daily basis in order to compensate for anticipated changes in overall market conditions. This rebalancing can result in frequent trading and increased portfolio turnover. L&I ETFs will therefore generally have higher operating expenses and investment management fees than other passive ETFs.

How to begin looking for an ETF to invest in

Step 1-Research:

Take a good look at the ETF you're interested in, unlike investing in one particular company you'll be investing in multiple - so look at the bigger picture. Generally, please be aware of ETF investments that involve economic or political instability, narrow, or non-diversified funds.

Step 2-Consider:

The time frame and the sector for investing. Also the expense ratio, the underlying index, and the fund size of an ETF.

Step 3-Purpose:

Consider if you are looking for dividend-paying or long-term growth.

Step 4-Strategy:

One-off or regular investment. Will you add all your money to the purchase of the ETF in one lump sum or will you choose to spread that money over regular intervals? Dollar-cost averaging allows you to invest a certain amount regularly, regardless of what the price is.

How to trade ETFs on Tiger Trade

Tiger Trade makes it simple to trade ETFs. Follow the steps below to start your ETF investment journey:

-

Download Tiger Trade from App Store or Google Play.

-

Open an account and fund it.

-

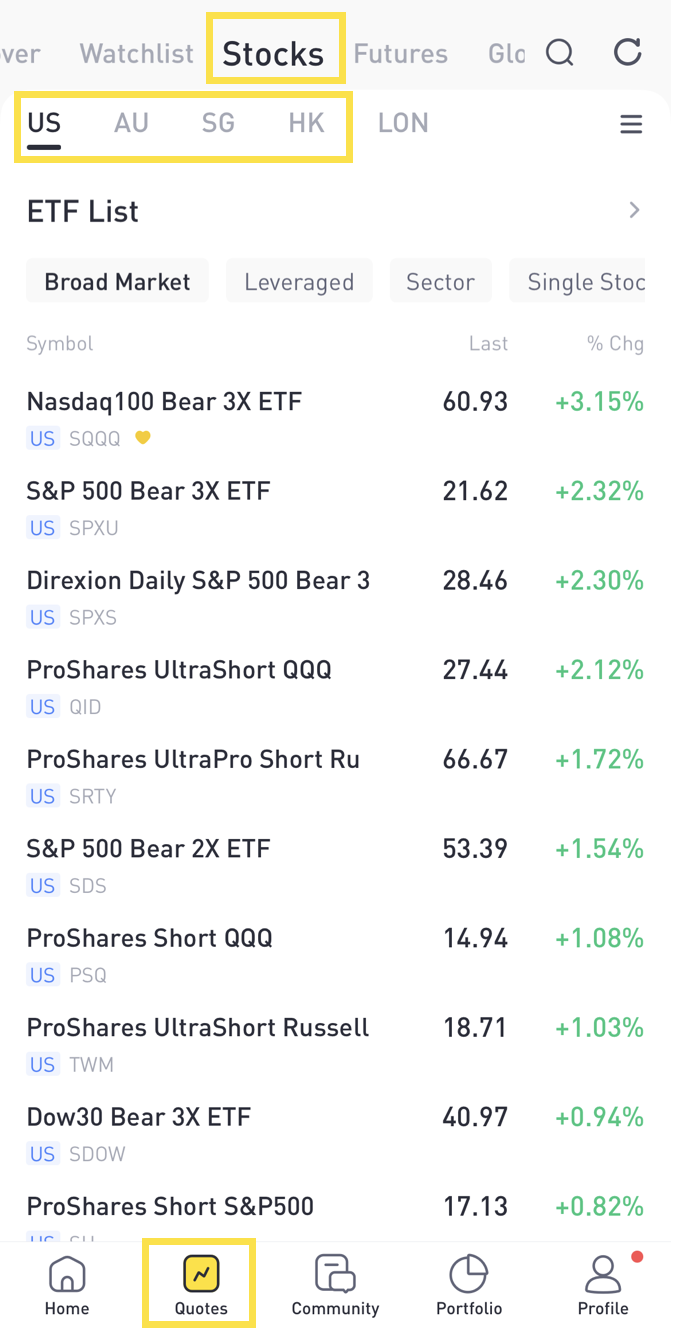

If you have no idea which ETF to trade, look through the ETFs list in the US, AUS, SG, and HK stock markets to get some ideas

-

If you have the intention of trading a specific ETF, search for it and add it to your watchlist

-

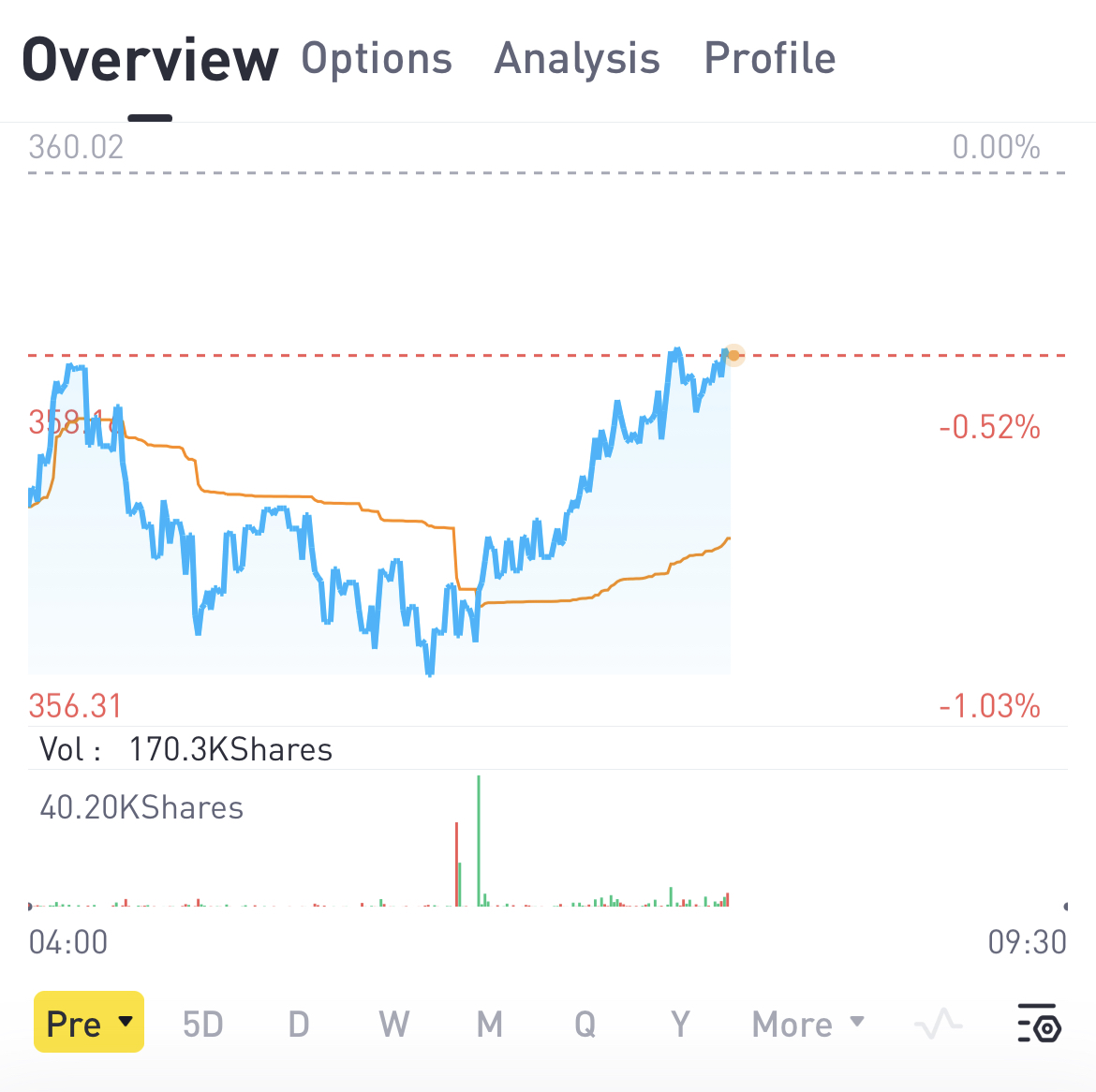

Click to visit the detailed page, you can see the real-time quote of the ETF

-

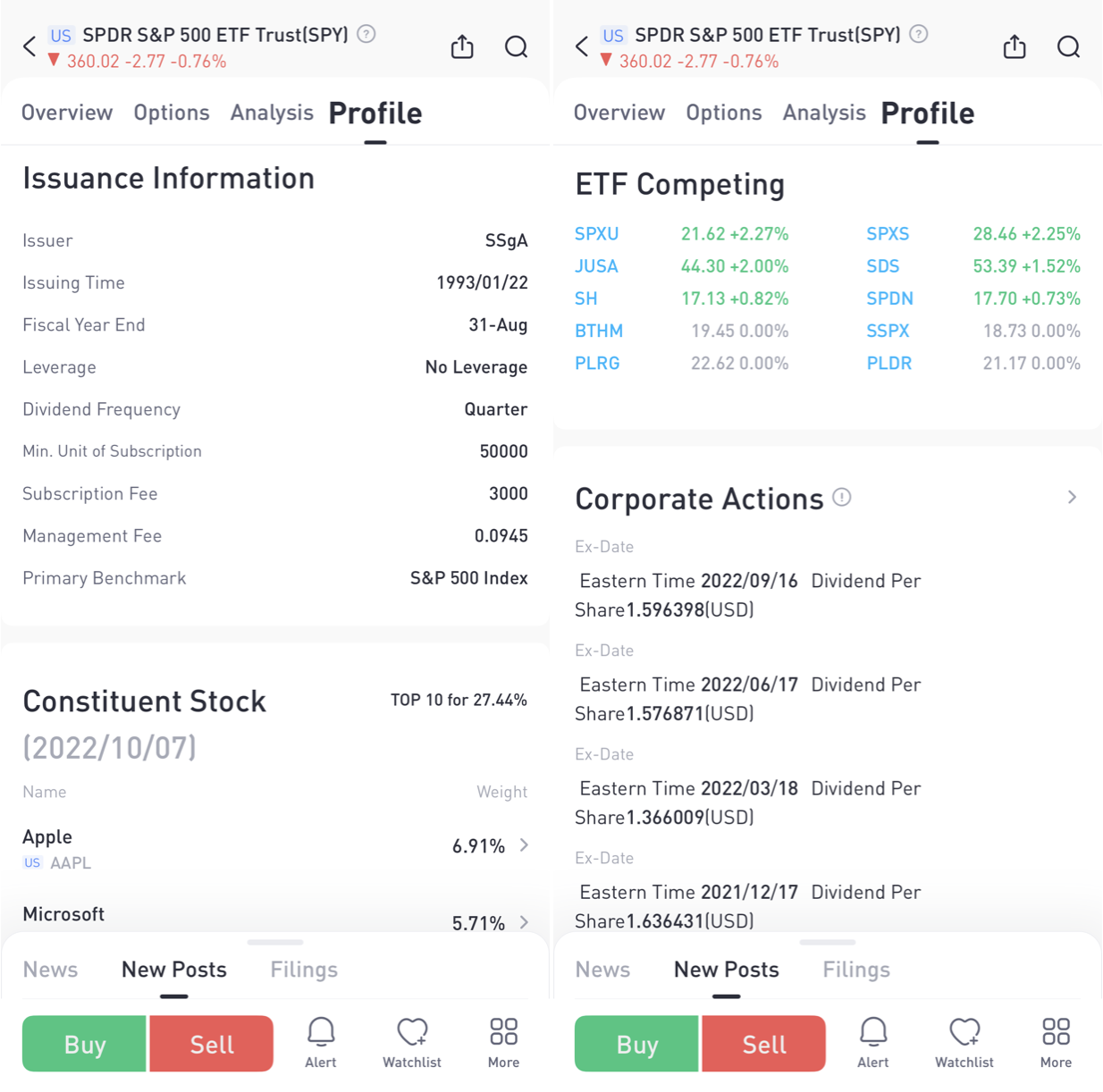

Under the tab Profile is comprehensive information about the ETF, such as constituent stock and dividends

-

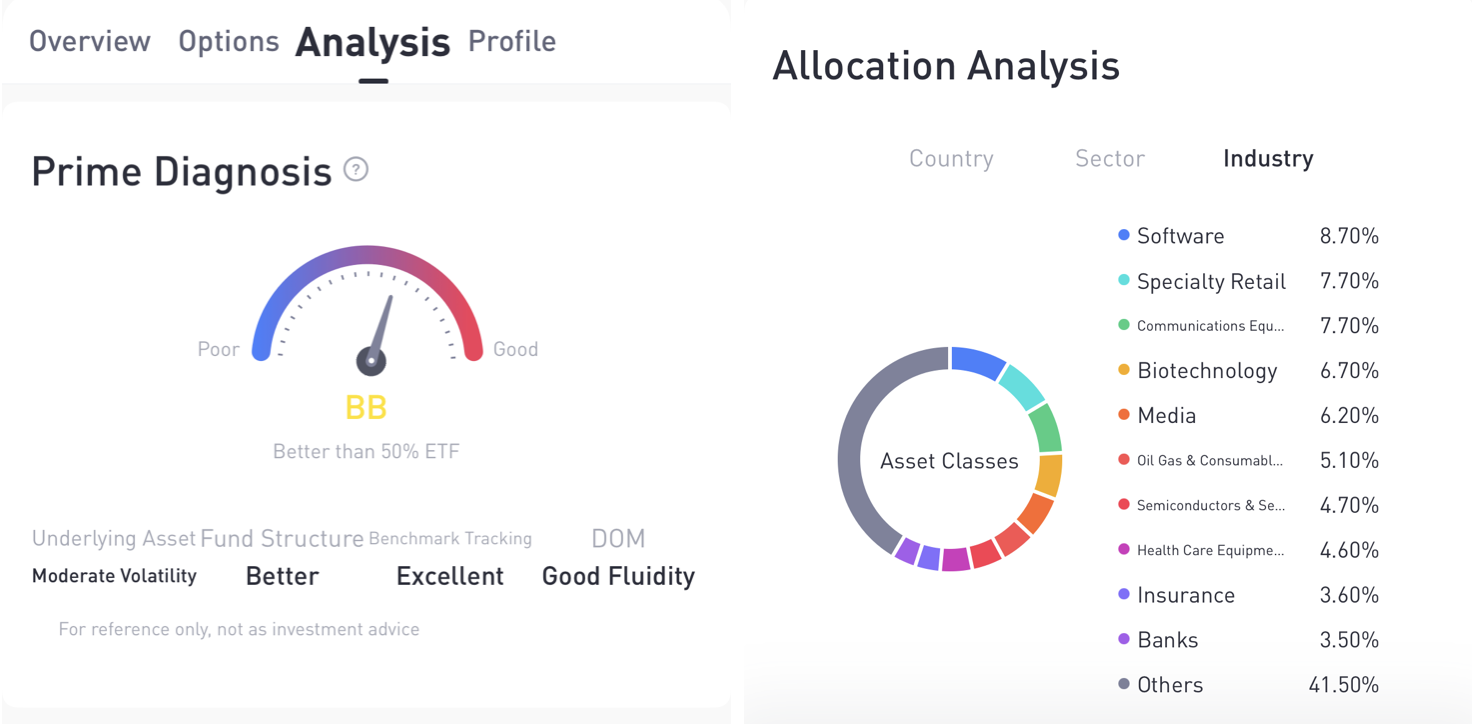

Under the tab Analysis of US ETFs, you can see analysis of the ETF, such as diagnosis and industry allocation

-

For advanced investors, ETF options can be a choice

-

Pre-and post-market trading is also available for US ETFs on Tiger Trade, which means a duration of 16.5 hours.

-

Click the 'Buy' button on the page, and input the price (in the case of a limit order) and quantity you want to buy and confirm. After the order is filled, you can see the ETF in your portfolio and its P&L.

Capital at risk. Inverse ETFs, Leveraged ETFs and Options trading carry high level of risk and may not be suitable for all investors. You should only trade with money you can afford to lose. See risk disclosures, FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only.

Tiger Brokers (AU) Pty Limited. ABN 12 007 268 386 AFSL 300767