The Tiger Investment Research team will present you the 2023's outlook for major assets today. Comprehensive analysis of how to invest well in 2023!

I. Review of asset performance and investment in 2022

In 2022, many investors had varying degrees of losses in their accounts. But why? What happened in 2022?

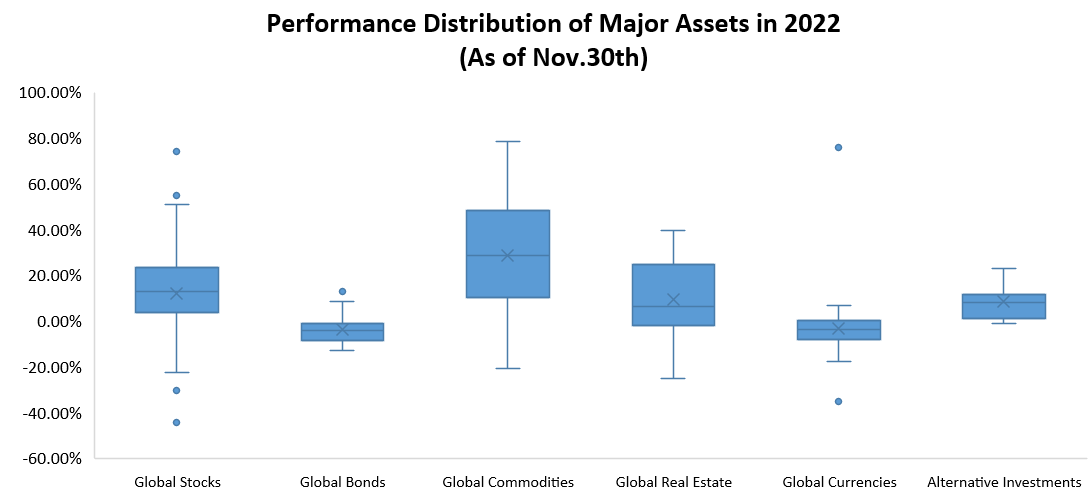

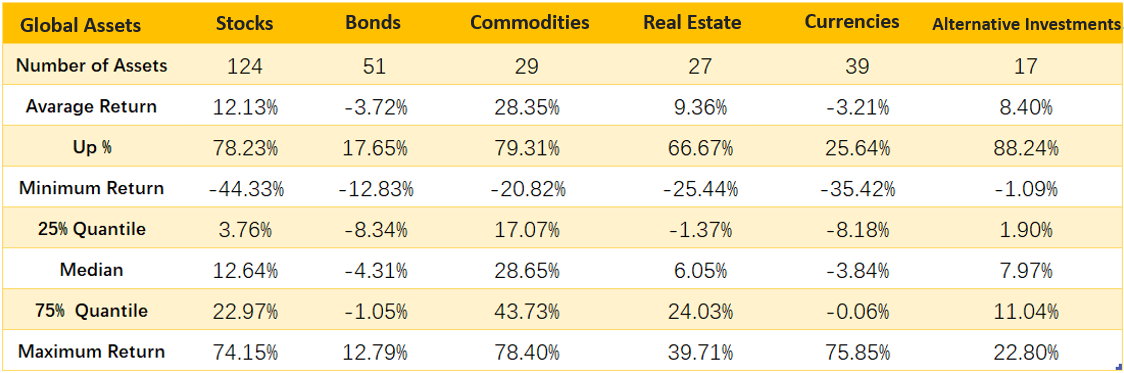

In order to assist investors in observing and comparing asset returns in different countries and regions, we summarised the returns of stocks, bonds, commodities, real estate, currencies and alternative investments in 53 countries and regions around the world, totalling 287 asset targets in six major categories.

As of November 30, 2022, the average return on these underlying assets in 2022 was just -10.24%. Of these, only 53, or less than 20%, have recorded positive returns this year.

Data from Bloomberg

-

2 Themes in 2022:

-

High Inflation and tighter than expected monetary policies

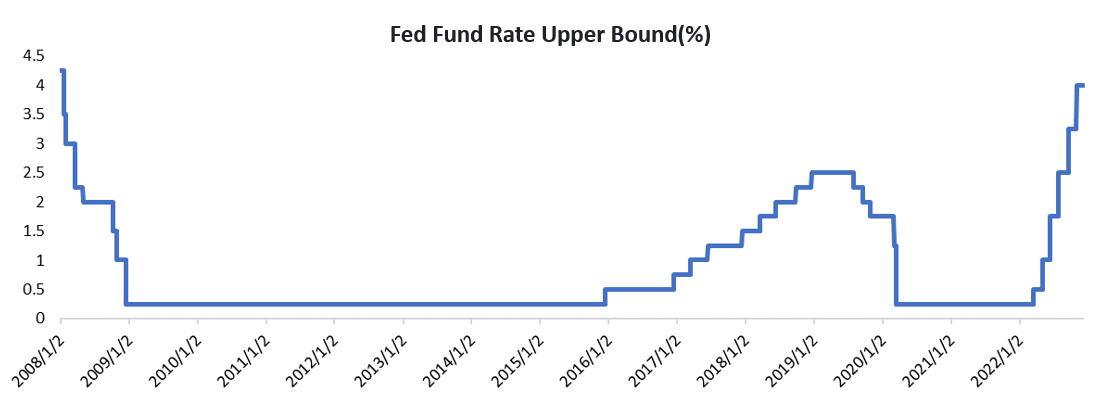

Let's move back to the beginning of 2022. Even the most hawkish researchers would not have predicted that the Federal Reserve would raise interest rates by 425 bps throughout the year.

Because after the 2008 global financial crisis, a researcher who predicted that the Fed would raise interest rates by 25 basis points once, nine times this year, to 2.5%, the long-run neutral rate, would be seen as a grandstanding maniac.

However, the Fed's ruthless policy of raising interest rates and its determination to reduce inflation were unexpected by Wall Street's elite.

After all, over the past decade or so, most people have become accustomed to low interest rates and low inflation; Once the Fed raised interest rates way more than expected, institutional investors and researchers could not even imagine, and had no way to cope.

Data from Bloomberg

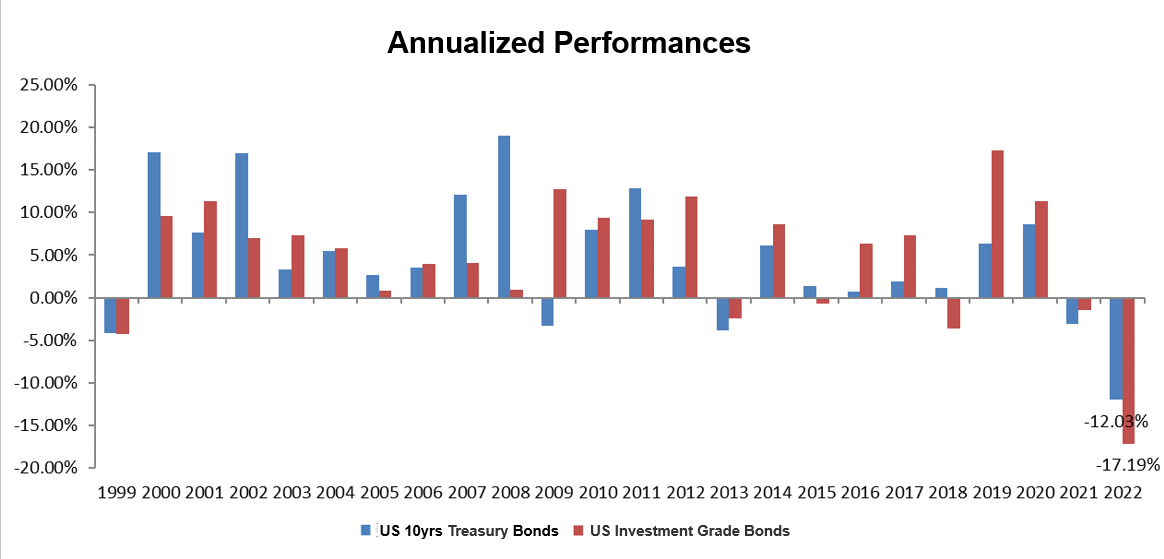

As a result, the larger-than-expected rate rise led to a sharp rise in short-end US interest rates, and the US bond market as a whole recorded its worst performance in more than two decades. Us stocks have seen massive valuation killings. Financial markets fell sharply, and investors' returns were no better.

US Treasuries and Investment Grade Bonds recorded their worst annual performance since 1999,Data source: Bloomberg

-

Continuous global disputes and the beginning of deglobalisation

Competetions between US and China, Russian invasion of Ukraine, Taiwan Strait crisis, financial sanctions, resource blockade, geo war...

The "global village" that has lasted for decades seems to have collapsed overnight.

The double blows of economic recession and the pandemic impact tore up the truth of the world, exposed the differences between the rich and the poor, stimulated the rise of protectionism, and accelerated the process of deglobalisation.

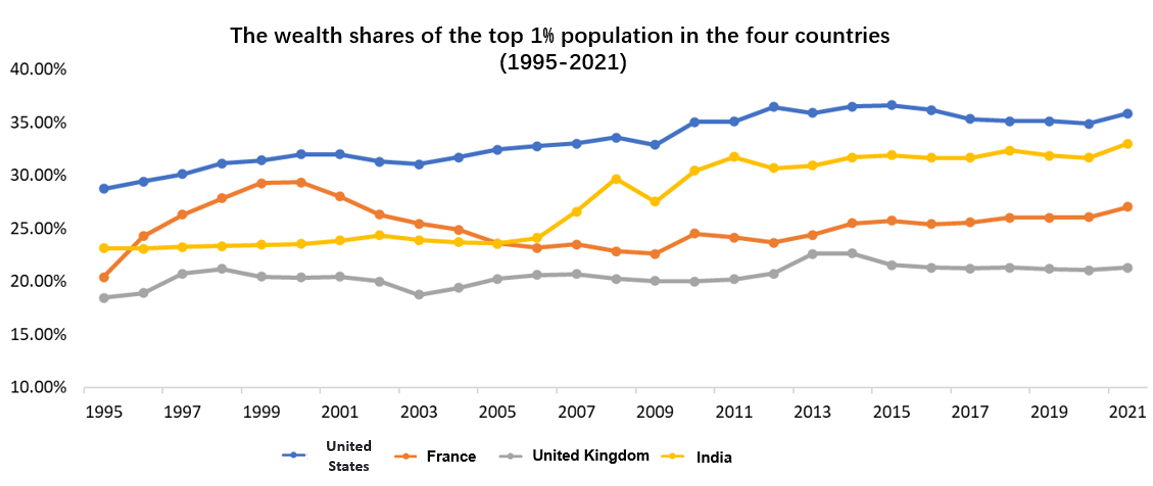

(1)Wealth problem: the gap between rich and poor, uneven distribution.

In the process of globalisation for nearly half a century, developed countries have transferred low-end manufacturing to developing countries in order to reduce their own costs.

To a certain extent, it has stimulated the economic employment of developing countries and improved global production efficiency, but it has also led to the continuous reduction of the domestic employment population in the long run.

On this basis, due to trade logistics, coastal areas have more business opportunities than the mainland. Moreover, in the general environment of long-term low-interest rates, countries with assets can benefit from the rise in asset prices and gain cheap leverage, which ultimately leads to the widening gap between the rich and poor.

The resulting social contradictions have promoted the rise of unilateral protectionism represented by the United States.

Source: World Inequality Database

(2)Competition issues: intensified conflicts and unilateral protection.

Unilateralism and protectionism are gradually rising, which challenges the general framework of a global division of labour and free trade.

On the one hand, due to the change in China's income structure, the demographic dividend has declined, affecting the supply of cheap goods;

On the other hand, the pattern of "United States being the only one superpower" is gradually evolving to "two powers standing side by side".

China is gradually marching towards high-value-added industries, which has triggered a strong counter-reaction in the field of trade and science and technology from US.

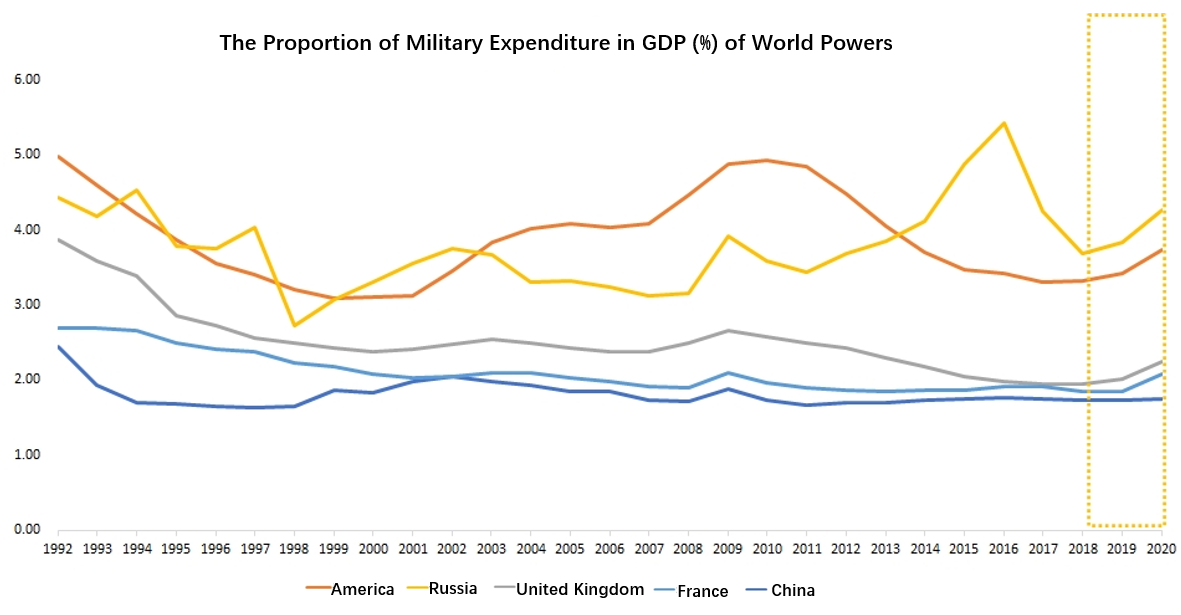

On top of this, geopolitical disputes have become increasingly fierce. It can also be seen from the US military expenditure of the "five permanent members" that the overall military expenditure has been in a downward trend for nearly half a century, but since 2018, the military expenditure of major countries has increased significantly. Russian Invasion of Ukraine is the product of increasingly fierce geopolitical disputes.

Data from World Bank

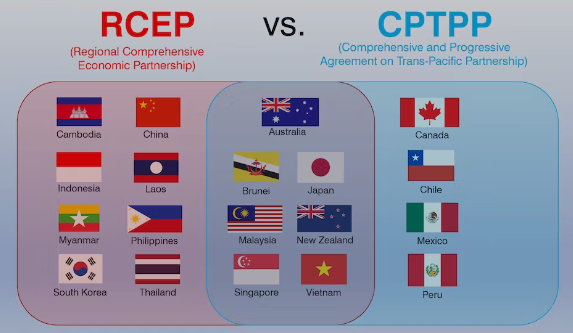

(3)Degloblisation: Regional Organizations take over Global Organizations

With the increasing proportion of geopolitical factors in consideration of political and economic decisions of major countries, in recent years, major events with the colourof deglobalisation have emerged one after another: such as Brexit in 2016, the Sino-US trade dispute in 2018, and the "Exit from several global organizations" of the United States in 2019.

At the same time, major sovereign countries and economies, on the other hand, are strengthening their regional links, and regional organisations such as ECEP, TPP, CPTPP, etc. are flourishing, The share of its internal transactions in global trade has been increasing year by year.

After the outbreak of COVID-19, policies to rebuiding industry and supply chains further strengthened the trend of deglobalisation. Russian Invasion of Urkraine led to the reshaping of the global energy order, which may also lead to the segmentation of the global energy market and the economic and financial decoupling between regional organisations in the future.

Source: businessdaily.com

In the context of deglobalisation, security has replaced the division of labour, and protection has replaced cooperation.

From food and energy upstream to manufacturing and production in the midstream to consumer services downstream, self-sufficiency and self-reliance are emphasized. Confronting each other, catching up with each other, and fighting fiercely is not only the main line of investment in 2022, but also the main theme of the medium and long term in the next 5-10 years.

With the Fed's frenzied rate hikes, economies colliding with each other and unilateral protectionism rising, the two themes of 2022 overwhelmed investors and left them with a lot of losses on their accounts.

However, 2022 will eventually pass. As investors, we should focus on what opportunities can be found in 2023?

Ⅱ. The evolution of the investment line in 2023

Due to various economic conditions, geopolitical conflicts, rising protectionism etc, there is a difference in the current countries’ economic state. The economy outcome of last year will continue to affect and usher countries to move towards different directions in 2023.

1. Where are the opportunities for the world's major economies?

(1) US: Inflation? Recession?

Tiger Investment Research Team's view:Inflation is topped, interest rate rises slowly and the certainty of recession makes it possible for the Fed to switch to cut rates.

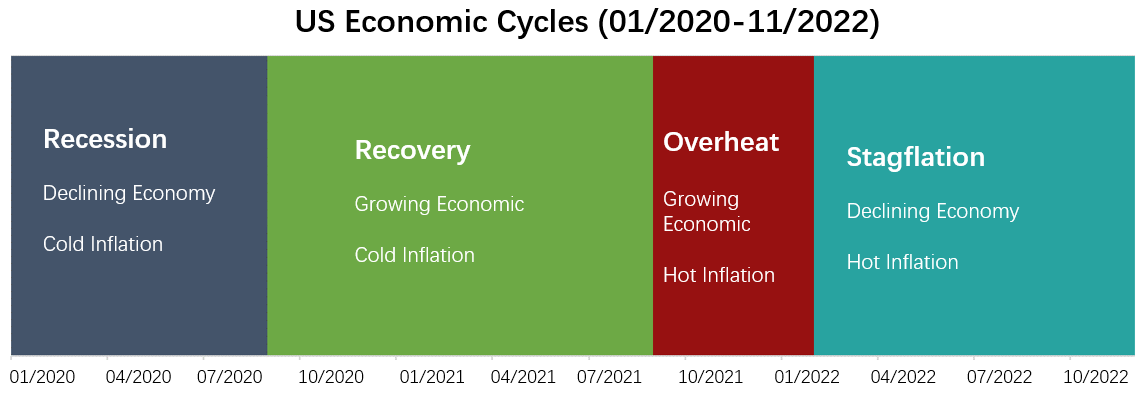

Chart made by Tiger Trade

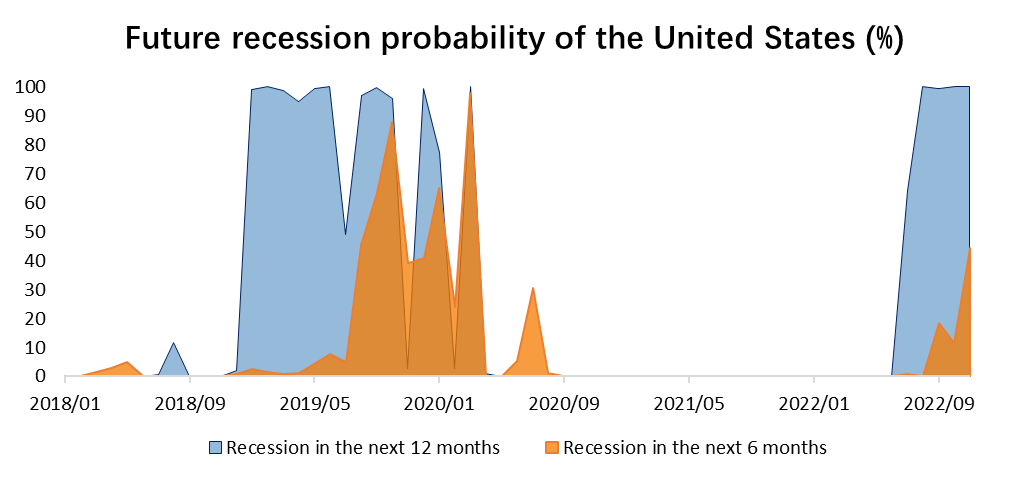

As of the end of November 2022, Bloomberg's recession forecast model showed a 44% chance of a US recession in the next six months and a 100% chance in the next 12 months.

Data Source: Bloomberg, chart made by Tiger Trade

Now that the probability of recession is so high in the United States, and the Fed is slowing down its rate hikes, is it likely to cut interest rates?

In fact, after four consecutive 75 basis point rate hikes, Fed Chairman Jerome Powell virtually assured a slower pace of rate hikes in a speech on Nov. 30, indicating that the Fed is entering the final phase of tightening.

But economic data so far suggest that growth is still strong, unemployment claims are still at rock-bottom levels, and household leverage and net charge offs of commercial and industrial loans are both low, which is clearly far from recession.

With strong economic indicators, the Fed rate cut is likely to be very low.

However, the positive economic data does not mean US recssion is behind us.. The biggest recession risk for US next year comes from business operations practices during the low-interest rate environment over the past decade. If companies are unable to adjust their operational methods to fit in a high-interest rate environment, sooner or later they will run into financial problems and lead to systemic risks.

The recent Musk stock pledge case is a typical example.

Source: Reuters

Such events could become more frequent next year, or the black swan that pushes the U.S. into recession.

Based on the above information, it concludes that:

|

In 2023, the US will probably still be stuck in stagflation. In the absence of a certain slowdown in Fed rate hikes and no black swans, overall U.S. stock returns will be much better than they have been this year. In the second half of the year, when inflation is down further but still way above 2%, the Fed could raise its inflation target in order to pivot to rate cut, as recession should be around the corner by year end.

|

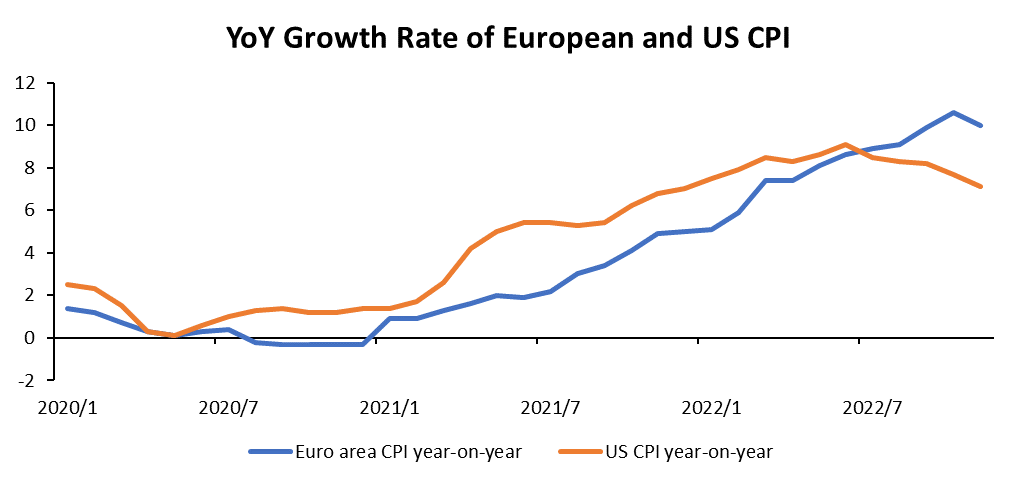

(2) Eurozone: Inflation! Recession!

Tiger Investment Research Team's view: As the war between Russia and Ukraine draws to a close, inflation is falling as energy and food prices fall, but the scope for interest rate cuts is limited.

The European economy has endured a huge shock this year: the energy crisis has greatly hampered normal production; inflation has eroded corporate profits and consumer incomes; and tightening monetary policy has dampened investment and consumption.

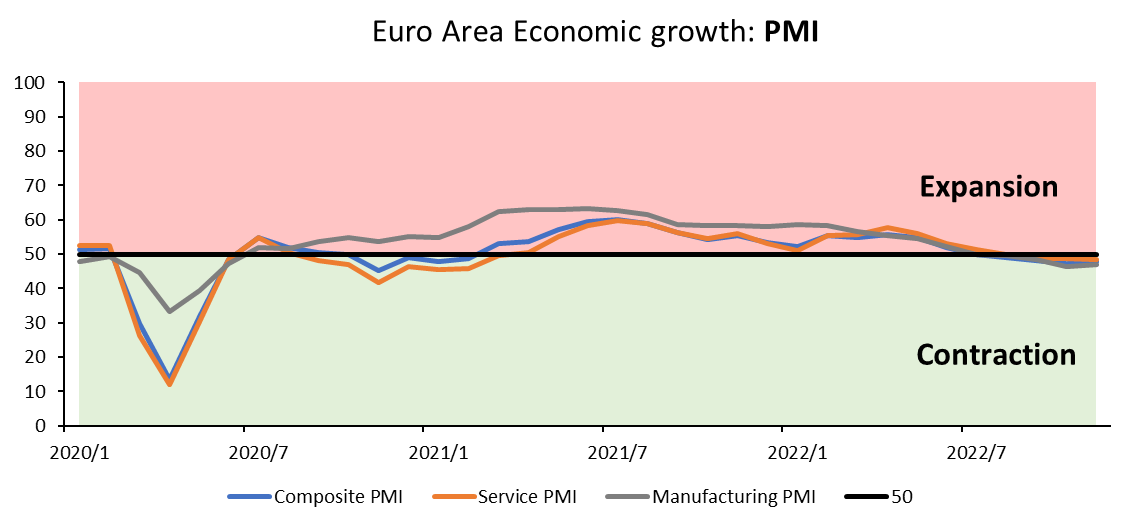

In fact, in the second half of 2022, PMI of the Eurozone's manufacturing and services has been consistently below the key reading of 50, reflecting that the European economy is contracting.

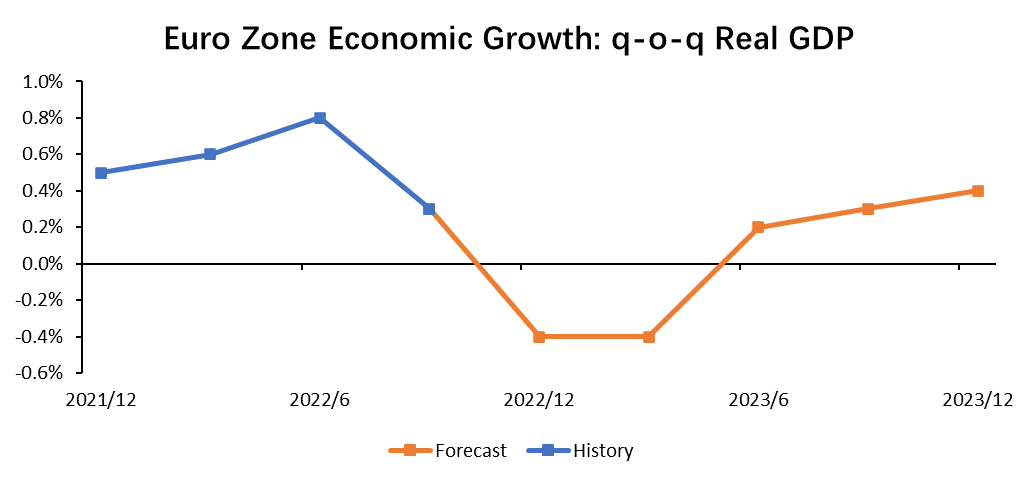

At the same time, institutions expect real GDP growth in the Eurozone to fall into negative territory in the fourth quarter of 2022 on a year-over-year basis. This implies that the economy could be heading into a shallow recession amidst inflationary erosion.

Data Source: Bloomberg, chart made by Tiger Trade

As the Russo-Ukrainian war is coming to an end, we see energy and food prices drove inflation down in November

Data Source: Bloomberg, chart made by Tiger Trade

In terms of core inflation excluding energy and food, the US inflation cycle has also fallen back ahead of the Eurozone. Core CPI in the US moved down in November year-over-year, while the Eurozone has yet to turn.

Based on the above information, it concludes that:

|

We predict that the base case for the Eurozone next year is that energy and food prices move downward as the shock of the Russia-Ukraine war wanes. It will drive overall inflation to top out and fall back. But wage and service inflation remain sticky. Against this backdrop, even if Europe steps into a shallow recession in the first half of the year, high inflation will constrain the ECB from adopting an accommodative monetary policy. Benchmark interest rates will remain at peak for a longer period. The performance of European equities is likely to be worse than that of the United States.

|

(3) China: Recovery? Recovery!

What opportunities will China have in 2023 when its economy is suffering from COVID-19 in 2022?

By Tiger Investment Research Team's view:The improvement of epidemic control and the expansion of consumer demand will lead to a cautiously optimistic economic recovery.

On December 14, the CPC Central Committee and the State Council issued the "Outline of the Strategic Plan for Expanding Domestic Demand (2022-2035)", which calls for the firm implementation of the strategy to expand domestic demand and develop a complete domestic demand system.

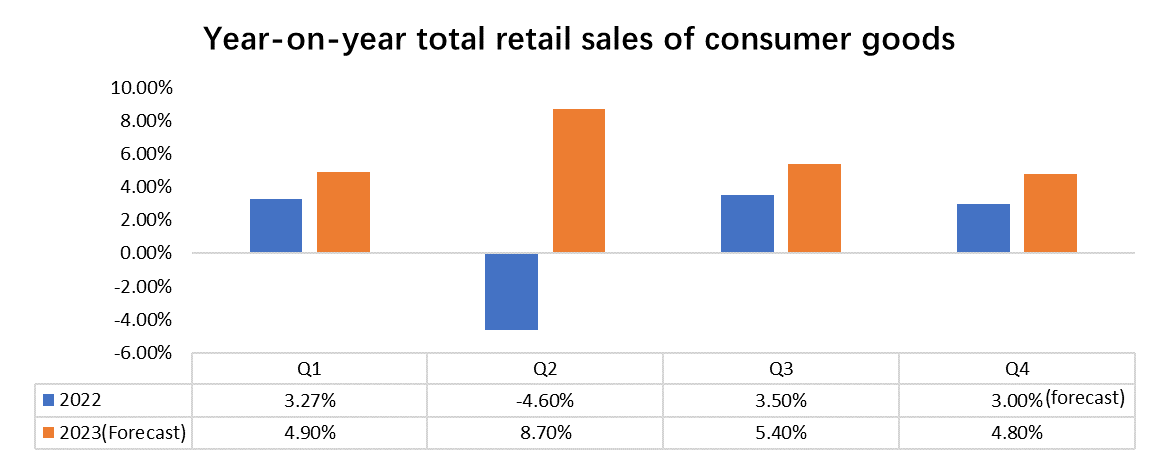

According to Bloomberg's consensus estimates, total retail sales of consumer goods are expected to grow by 4.9%, 8.7%, 5.4% and 4.8% year-on-year in the four quarters of 2023, which is much better than the growth in the same period of 2022.

Data Source: National Bureau of Statistics of China, Bloomberg, Chart made by Tiger Trade

Of the three engines of the economy, consumption already has strong policy support. What about the remaining two, investment and exports?

Investment perspective:

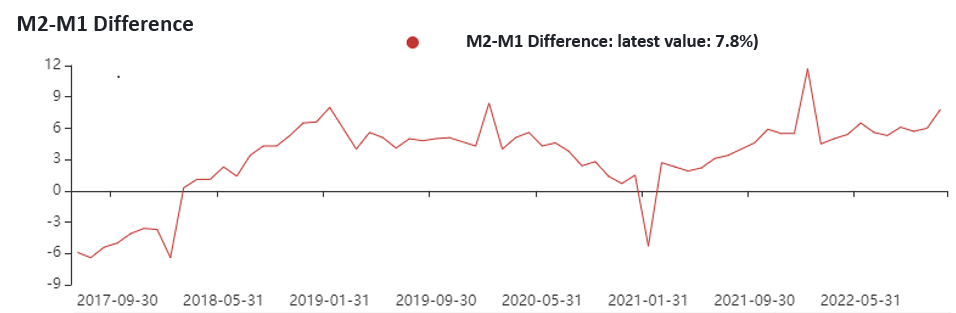

In 2022, the consumer demand side and the production investment on the supply side are both sluggish. For one thing, as of mid-December, the M2-M1 scissors differential continued to widen, and the amount of "dead money" is still increasing.

The willingness to produce has not seen a significant increase for the time being. Even if the central bank money supply is sufficient, the social financing data doesn't improve.

Data Source: Wind, Chart made by Tiger Trade

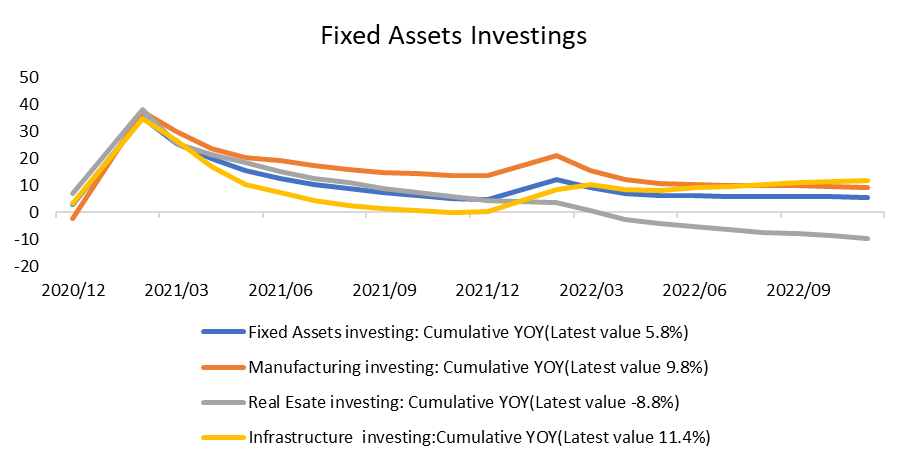

On the other hand, fixed asset investment continues to be sluggish year-on-year; and the willingness to expand production remains very low.

Data Source: Wind, Chart made by Tiger Trade

On the export side, consumer demands from major developed countries are sliding as they are heading closer to recession, and the trend of deglobalization may also dampen foreign trade demands.

Based on the above information, it concludes that:

The impact of the pandemic in China will soon be over, and economic growth will be the focus in 2023. From the perspective of the economic drivers, foreign exports are under pressure from external influences; investment and production will still be affected by the pandemic; the stimulation of domestic demand, especially consumption, will become the top priority for economic recovery.We believe that China has sufficient experience and abundant means to stimulate consumption. Hence, we remain cautiously optimistic about the road to consumption recovery in 2023. On the premise of recovery, Hong Kong stocks and Chinese stocks are also expected to get back on track and rally like 2017.

-

Where are the opportunities in the industrial chain?

Credit Suisse star analyst Zoltan Pozsar believes that in the current economic wars amid deglobisation,they are about control: The Control of technologies, commodities, productions and straits-chokepoints.

The resulting impact on economic efficiency brought by the transfer of high-end manufacturing industry chain, as well as the investment in resources and supply chain, will determine the new pattern of industrial chain in the coming year and even many years, and will bring new investment opportunities

(1) Semiconductor--the global semiconductor competition is increasingly fierce;

China wants to break down technological barriers; America wants to hold on to them and stay ahead; As a result, Europe and other regions heavily involved in the division of labor also began to increase investment in the whole industrial chain to cope with the tide of anti-globalization.

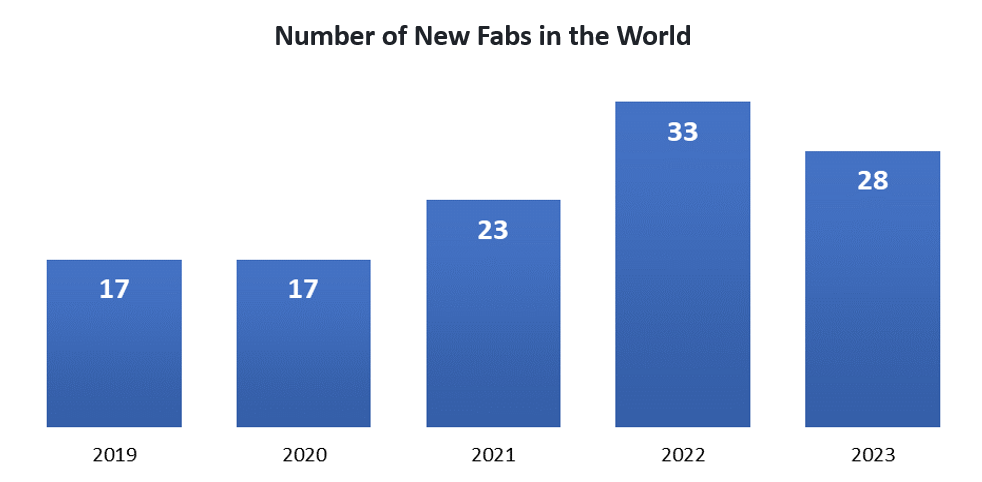

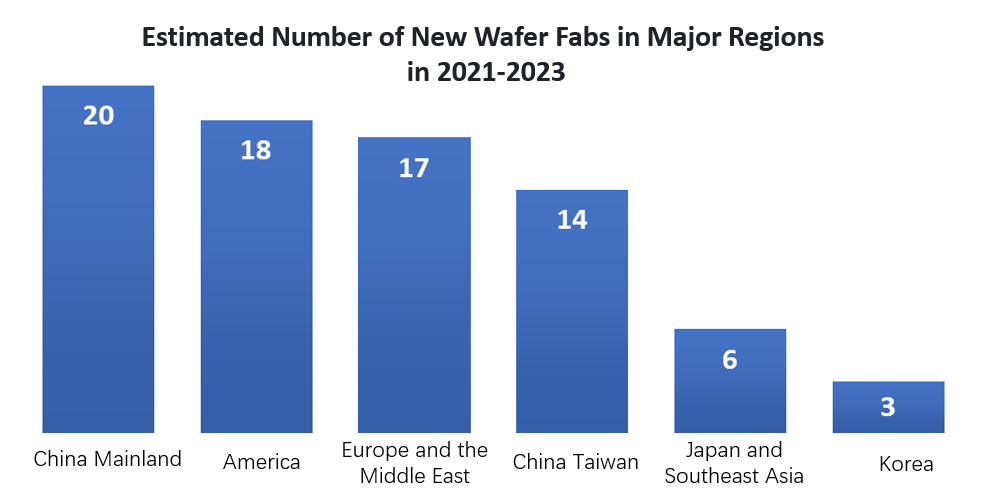

As a result, the global trend of building factories sprang up. The number of new fabs has soared as countries scramble to subsidise and invest.

Data source: SEMI World Fa Forecast Report, Chart by Tiger Trade

However, in terms of supply and demand, is this good for the semiconductor industry?

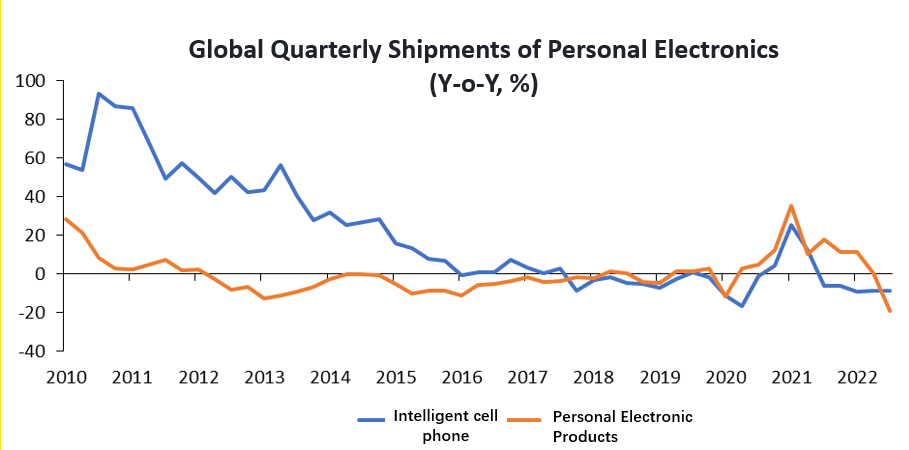

The demand side, particularly from the point of view of private consumption, is actually continuing to decline. The PC sector has been experiencing negative growth for a long time since 2012, and mobile phones have also entered the bottleneck since 2017. The stay-at-home economy is just a wave of consumption that is falling sharply after a peak in 2021.

Data source:Wind, Chart made by Tiger Trade

On the supply side, huge investment and subsidies create excess supply and huge price shocks. The current anti-globalization will make countries and regions turn from cooperation to competition, and even into vicious competition, which may eventually lead to the bankruptcy of enterprises. As in the memory market around 2010, Samsung's "counter-cyclical" investments created an oversupply of memory chips and prices plunged, bankrupting two of the top five players.

Based on the above information, it concludes that:

|

Semiconductor investment opportunities and crises coexist. For China, which wants to break through the global technological blockade independently and controllably, it may be a good opportunity to implement domestic substitution. However, for regions deeply dependent on the global industrial chain, such as China's Taiwan, the semiconductor industry built under the European and American systems faces an outflow crisis, which may cause great harm to the local economy.

|

(2) New energy -- mineral resources become a battleground;

All kinds of capital in the world to key minerals, especially the mineral resources of new energy metals chase increasingly intense.

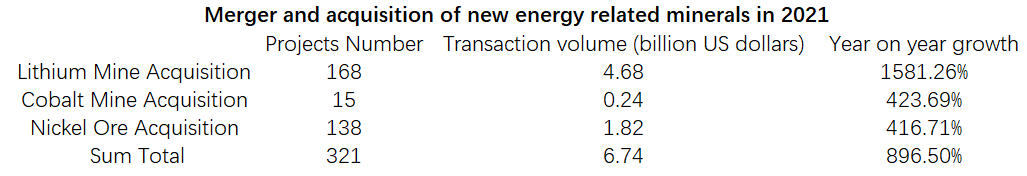

The following table shows that in 2021, the number and value of lithium, cobalt and nickel mergers and acquisitions increased significantly year on year. At the same time, countries have imposed investment controls on key minerals. On November 2nd, the Canadian government asked three Chinese companies to divest their investments in lithium mining companies in Canada, including their rights under the investments, citing national-security concerns.

Source: China Nonferrous Metals News, Chart made by Tiger Trade

In addition to metallic elements such as lithium and cobalt, which are directly related to the development of new energy sources, silver's role in the energy transition cannot be ignored.

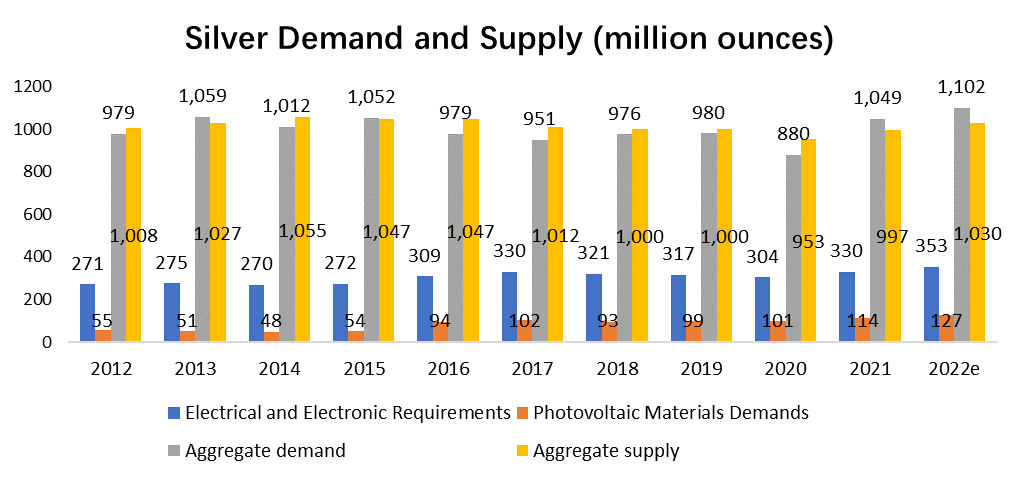

Demand for silver in electrical and electronic and photovoltaic materials has increased over the past decade, with total demand expected to hit a 10-year high this year and a supply deficit of more than 50 million ounces for the second year in a row.

Data source: The Silver Institute, chart made by Tiger Trade

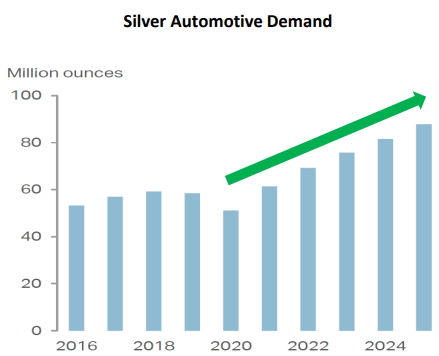

Metals Focus estimates that demand for silver in electric vehicle production will continue to rise year on year in the future.

Data Source: Metals Focus

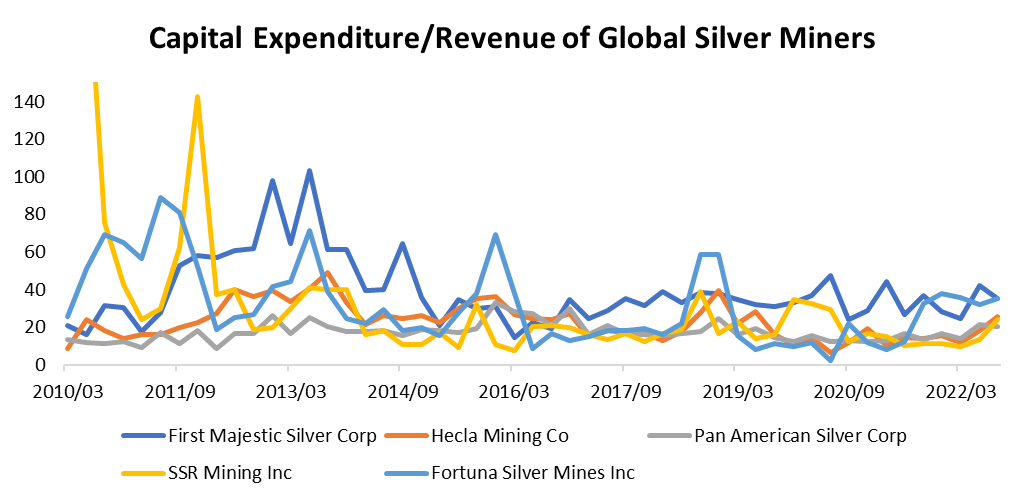

Although capital expenditure as a percentage of revenues at the world's major silver miners has risen in each of the past two years. However, silver miners are still in the early CAPEX cycle compared to 2011-2012 2011-12, when silver prices were soaring, and there is still plenty of room for supply to rise to meet new demand from the new energy industry.

Data source: Bloomberg, chart made by Tiger Trade

Based on the above information, it concludes that:

|

Mineral resources in or not in the key mineral list of major countries, all have strong demand in the next few years. The gap between supply and demand of related resources and the evolution of the capital expenditure cycle of mining companies will create a new round of investment opportunities, which is the main line of long-term investment in the background of deglobalization.

|

-

There are real alternatives for stocks

Tiger Investment Research Team's view:U.S. bonds could be a boon for investors with a low risk tolerance.

The immediate consequence of the trend against globalisation, which has reduced industrial efficiency and increased competition for resources, is the end of the era of low inflation and the advent of higher interest rates.

US real interest rate curve is now about 1% for all maturities, and corporate bond yields and MBS/ABS yields are all at their highest level in the past decade. This means that institutions can have much more opportunities to beat inflation now by allocating to bonds or structural products

Inistitutions investors no longer have to raise their risk appetite to invest in stocks.

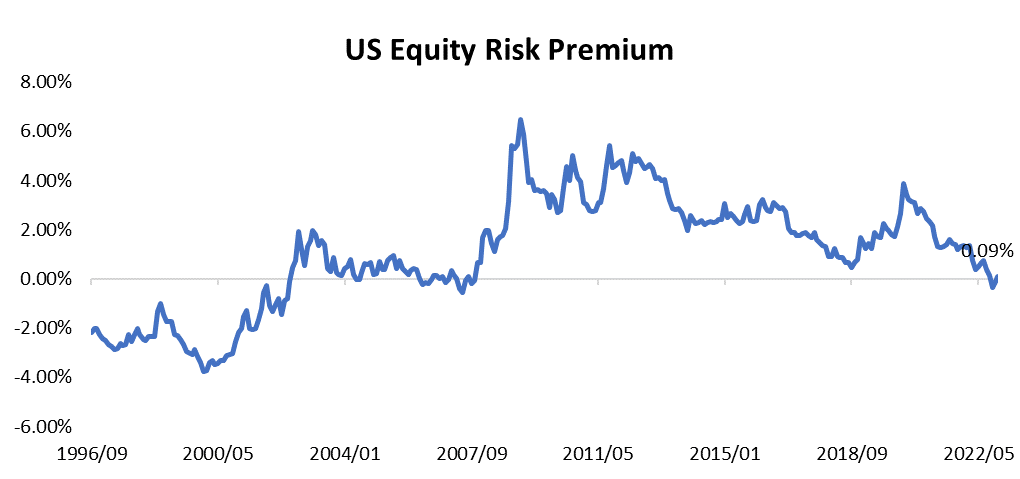

Our measure of the US equity premium, constructed from the inverse of the Shiller PE minus the US 10-year Treasury rate, shows that the current risk premium for US equities over US Treasuries is close to zero, higher only than in the late 1990s. That means the value of stocks relative to Treasuries is near historic lows as interest rates have risen sharply.

Data source: Bloomberg, chart made by Tiger Trade

Based on the above information, it concludes that:

|

In an environment of high interest rates and falling earnings expectations, if you are bullish on a company, you are likely to be rewarded with lower expected earnings and higher volatility than in the past. Buying its corporate bonds, on the other hand, offers a solid yield that beats inflation over time and less risk, which is a boon to the prudent investor and gives you a wider range of asset allocation options.

|

Ⅲ. Outlook of major asset classes in 2023

Stock outlook::

|

US stocks

|

|

|

Hong Kong stocks

|

Hong Kong stocks will have great potential to repair valuation and performance, enjoying good share price gains in 2023.

Note: However, under the geopolitical risk amid deglobalization, and the changed business models adapting to the long term strategic policy change of the Chinese government, it should be noted that the capital and fundamentals of Hong Kong stocks have changed dramatically, making the long term valuation of Hong Kong stocks extremely difficult to return to 2020-2021.

|

|

Europe and Japan stocks

|

|

|

Emerging market stocks

(China)

|

The reopening of China is helping to repair the performance of previously stressed consumption and real estate, thereby boosting demand for industrial metals exports from resource countries in emerging markets. In the context of de-globalisation, the politically stable and neutral resource countries in emerging markets are expected to continue to make a fortune, and their stock markets are expected to continue their excellent performance in the first half of next year. In the second half of the year, as Europe and the United States move closer to recession, emerging markets that are more volatile than U. S. stocks will also face a sharper decline.

|

Bond outlook:

|

Emerging market bonds

|

Emerging market government bonds are expected to benefit from the peak of the dollar. Brazil's central bank, which raised interest rates a year ahead of the Fed, peaked in the third quarter of this year; Central bank policy rates of India and Mexico are expected to peak at Q1, and emerging market government bonds are expected to have good yields in the first half of next year.

|

|

US Treasuries

|

We expect the Fed to raise interest rates for the last time in march next year, bringing the benchmark interest rate to 5%-5.25%, and may cut interest rates by the end of the year because of the recession. According to this path, the reasonable pricing of interest rates on two-year Treasuries next year should fluctuate between 3.5% and 4.5%, with an obvious downward trend in the second half of the year.

Bonds issued by high-quality companies generally have great allocation value. We can enjoy the high credit risk premium by correctly judging companies' credit risk based on their financial statements and operating conditions.

|

|

Others

|

As Japan's core CPI has been above 2% for five months in a row since May this year, and the upward momentum is rapid, if it cannot be alleviated in the next few months, it may trigger the BoJ to move from abolishing YCC to raising interest rates when the BoJ leadership changes in April next year. Against the backdrop of rising interest rates, Japanese bonds are expected to replicate the dismal performance of US Treasuries this year.

In addition, with interest rates on Japanese bonds rising and inflationary inflection points in Europe still lagging behind those in the US, there is still further upside pressure for European bond rates.

|

Gold, commodity outlook:

|

Gold

|

We expect that the strong recession expectations and sticky inflation, coupled with inevitable geopolitical risks, will make gold a core asset to invest in our 2023 asset allocation plan.

The risk is that the US economy is so strong and achieving a soft landing even if the Fed continues to raise interest rates way more than 5% and remains above 5%.

|

|

Silver

|

We are also bullish on silver as a commodity in 2023.

Silver has a similar precious metal monetary property to gold, so it has a positive correlation with the trend of gold. At the same time, the industrial use of silver is expanding, with demand for both photovoltaic and new-energy car batteries rising year by year.

The risk is that the global economy is heading for recession, dampening demand for new energy expansion in the short term.

|

|

Copper

|

Industrial metals, notably copper, will benefit from a boost to demand from China's reopening and stabilisation of the Chinese real estate market. However, after the repeated impact of COVID-19 in 2022, the boost to China's domestic demand is likely to be tortuous and slow.

In degloblization scenario with high commodity demand, we remain bullish on the long-term post-recession performance of industrial metals, which is likely to occur in late 2023 to early 2024.

|

2022 is over and 2023 is just around the corner. In the new year, the US interest rate hike is expected to peak, China's Zero-Covid policy is fully lifted, the Russian-Ukraine war in Europe is easing, and competition between countries is intensifying...

2023 is a year of opportunity and crisis. May you seize the opportunity to avoid crisis. Wish you success in the coming year!

Capital at risk. See risk disclosures, FSG, PDS, TMD and T&Cs via our website before trading. Information provided may contain general advice without taking into account your objectives, financial situations or needs. Past performance is no guarantee of future results. Graphics and charts are for illustrative purposes only.

Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767